Alright folks, let’s talk about something scary but real: Stripe shutdowns. You know, when your main payment processor just decides to pull the plug on you. Happened to me, and it was a mess. But I survived, and I’m gonna share exactly how I set up my backup plan before the hammer dropped.

The Scare and The Realization

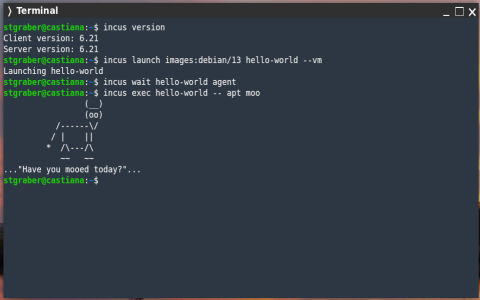

I was running an online service—nothing controversial, just standard digital products. Everything was humming along nicely, sales coming in through Stripe, money hitting the bank. Standard stuff. Then, I started seeing these weird warning emails. Super generic at first, about “compliance review” or “updated terms.” I brushed them off. Big mistake.

One Tuesday morning, I woke up to an email saying my account was suspended pending review, and funds frozen. No real explanation. Just a vague reference to ‘high risk.’ I panicked. All my income was tied up. I spent two solid days trying to reach a human being at Stripe. It was a black hole of automated responses.

That immediate financial blockage was a huge wake-up call. I realized relying on a single payment gateway, especially one that can cut you off with zero notice, is just plain stupid for any business owner. I immediately started scrambling for alternatives, but the damage was already done—lost sales, frozen cash.

Building The Redundancy Net

Once I got the account reactivated (it took two weeks and a ton of documentation), I swore I would never let that happen again. I immediately started setting up backups. This wasn’t just about having an account ready; it was about having a system ready to switch instantly.

First step: Dual Processing.

- I signed up for a competitor—let’s call it “Gateway B.” I made sure their fee structure was acceptable and, critically, that they handled my specific type of digital goods without fuss.

- I didn’t just sign up; I integrated it fully into my platform. This was key. I set up my checkout page to be capable of processing payments through both Stripe and Gateway B.

- I used a smart routing layer. Initially, I kept 90% of traffic going to Stripe, just to maintain stability, but I pushed 10% to Gateway B. This let me test Gateway B’s reliability and speed with live transactions. It also ensured Gateway B didn’t suddenly look suspicious if I dumped 100% of my volume on them later.

Second step: Data Portability and Subscriptions.

If you run a subscription service, this is where it gets hairy. Migrating thousands of active subscriptions is not fun. Stripe makes it difficult to just export customer card data—security reasons, obviously. But you need a plan for what happens when you lose access.

- I focused on tokenization. I implemented a third-party vault system that stores customer payment tokens independently of Stripe or Gateway B. This way, if one processor failed, I could theoretically pass the token to the backup processor and restart the billing relationship without asking the customer for their card again. This was the most complex part but the most critical for continuity.

- I documented every step of the subscription migration process. I wrote a manual for my team: “How to move 1,000 subscribers from Stripe to Gateway B in 48 hours.” This included the exact API calls and manual steps required.

Third step: Geographic and Legal Separation.

Sometimes, these shutdowns are regional or based on the entity you incorporated. I formed a second corporate entity in a different state, totally separate from the first business. This secondary entity also opened up a merchant account with yet another processor—”Gateway C.” This was my absolute last line of defense. If Stripe and Gateway B both exploded simultaneously due to some industry-wide issue, Gateway C, tied to a separate legal structure, would hopefully remain untouched.

The Test Run and Final Thoughts

I actually performed a simulated failure. I intentionally routed 100% of my traffic away from Stripe to Gateway B for 24 hours. There were a few hiccups with webhook notifications and reporting, but payments kept flowing. Crucially, I proved the switch could be done in under 5 minutes.

When you’re making real money online, you cannot afford to have a single point of failure in your cash flow. Setting up these layers—dual processors, independent tokenization, and a legally separate backup—took time and money, yeah, but that peace of mind? Priceless. If Stripe decides to shut me down again tomorrow, I flip a switch, and the business keeps running. That’s the goal.