I’ve been messing around with different payment platforms for my little side gig, you know, selling some handmade stuff online globally. I started with the usual suspects, PayPal, Stripe, but the fees and conversion rates were just eating into my margins. Someone on a forum suggested I check out Airwallex. So I did the whole deep dive, signed up, and actually ran some real-world transactions through it.

Getting Started: Smooth Sailing, Mostly

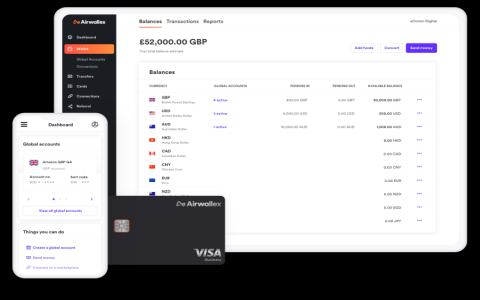

The signup process was pretty slick, gotta give them that. It was all online, pretty fast. Uploaded my business docs, waited a couple of days for verification. The platform itself, the dashboard, is clean. It’s definitely designed for businesses that deal in multiple currencies a lot, which is exactly what I needed.

First thing I noticed was setting up global accounts. They let you open bank accounts in different currencies, like USD, GBP, EUR, AUD, all within their system. That was a game changer for me. Instead of getting hit with bank conversion fees every time a customer paid in USD, I could just receive the USD straight into my Airwallex USD account.

The ‘Pros’ They Advertise: The Good Stuff

The exchange rates are genuinely good. This is the main reason I switched. Compared to Stripe or my local bank, the spread was much tighter. When I needed to convert my accumulated USD back to my local currency, I felt like I was actually getting most of my money, not just handing a chunk over to the bank.

Sending payments globally was also super efficient. I pay some of my suppliers in China and Vietnam, and using Airwallex felt quicker and cheaper than using a wire transfer through my regular bank. The fees for international transfers were transparent and low, usually a fixed small fee, or sometimes even zero if it was to another Airwallex user.

I also liked their borderless cards. I got a virtual card linked to my different currency accounts. This meant when I bought supplies online from a US vendor in USD, the payment came directly from my USD balance, avoiding conversion fees completely. This seemed genius at the time.

The ‘Cons’ They Don’t Shout About: Where It Gets Tricky

Okay, here’s the stuff you only find out once you’re deep in the trenches. Airwallex is great for receiving and holding foreign currency, and for sending payments. But for collecting payments directly from a website? It’s not a standalone payment gateway like Stripe or PayPal.

I initially thought I could just plug it into my Shopify store and be done. Nope. You have to use Airwallex’s accounts to receive funds cleared by other gateways (like Stripe or PayPal) or directly via bank transfer. It’s an infrastructure for money movement and holding, not usually the front-end processor for consumer credit cards. This added a layer of complication. I still needed Stripe to process the actual credit card swipe, and then route the payout to my Airwallex accounts.

Customer service can be slow. When everything is running smoothly, it’s great. But I had one issue with a payment being flagged for extra compliance checks—it was a slightly larger amount than usual. It took ages, seriously days, to get a clear answer and resolve it. You deal mostly with chat or email, and the response times aren’t always immediate, which can be stressful when cash flow is dependent on it.

Also, the compliance requirements are strict, which is probably a good thing for security, but annoying when you’re trying to move fast. They sometimes ask for verification documents for seemingly routine transactions, especially if you deal with regions they consider high-risk. It felt like they were constantly watching, which, again, is the price of dealing with global finance, but it slows things down considerably when they randomly pop up asking for proof of invoice or business registration for a small payment.

The Final Verdict After Six Months

I’m sticking with them, mostly because the savings on foreign exchange fees are just too substantial to ignore. But I had to adjust my workflow. I still use a traditional processor to handle the front-end customer payments, and then Airwallex acts as my global treasury—where all the different currencies land, sit, and wait for me to pay suppliers or convert them home.

If your business relies heavily on fast, direct consumer card processing and you only deal in one or two currencies, maybe stick to Stripe. But if you’re pulling in money from around the world and constantly juggling multiple currencies, Airwallex will definitely save you a bundle on conversion fees. Just be prepared for the compliance steps and the occasional slow customer service hiccup. It’s a tool built for efficiency on the back end, not necessarily lightning-fast customer support on the front end.