The Weekend Swap Trap: Why FX is More Expensive on Sundays

Man, I’m telling you, I just got back from sorting out some personal currency exchange stuff, and it reminded me of this thing I’ve been meaning to share. It’s about why trading foreign exchange, like just straight up swapping dollars for euros, often feels like a rip-off on a Sunday. It’s a subtle thing, but once you see it, you can’t unsee it. This isn’t about some fancy high-frequency trading; this is about simple stuff most folks do, maybe prepping for a trip or settling an overseas payment.

I started digging into this properly a few months back. I was helping my buddy move some decent chunk of money across borders—he needed to pay a deposit fast. It was late Saturday night, moving into Sunday morning, and the rates looked terrible. Like, noticeably worse than Friday afternoon. I initially thought, okay, maybe it’s just general market volatility. But when Monday rolled around, the rate magically improved without any huge political or economic news breaking. That smelled fishy.

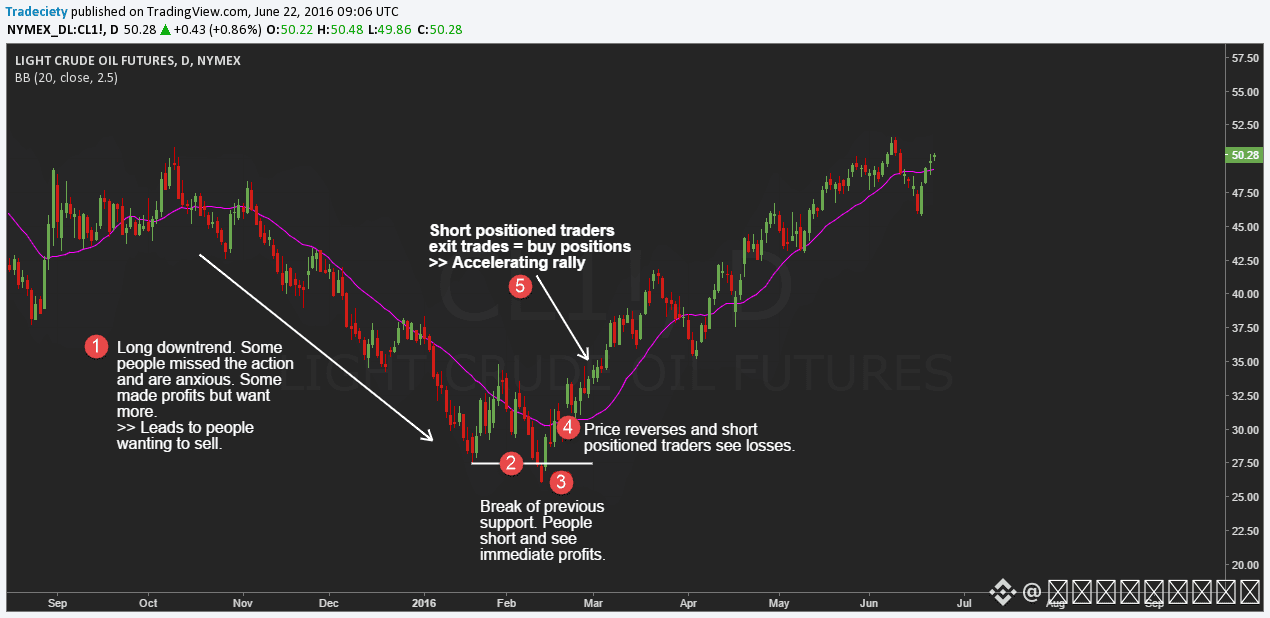

My first move was to compare the spreads. I wasn’t looking at interbank rates, forget that noise. I was looking at what common services offer—your online brokers, payment platforms, even some of the more accessible retail FX houses. I opened accounts, funded them with small amounts, and just watched the EUR/USD and GBP/USD pairs like a hawk, specifically tracking the difference between the ‘buy’ and ‘sell’ price—the spread.

What I found was pretty clear. During the week, when New York, London, and even Tokyo are open and churning, the spreads are relatively tight. Competition keeps them honest. But come Saturday evening, when Sydney closes and the rest of the world is asleep or winding down, liquidity dries up. I mean, it goes down the drain.

I tracked the spreads every hour for three consecutive weekends. This meant waking up stupid early on Sunday morning, staring at charts on my second monitor while trying to drink coffee. It wasn’t fun, but the data was consistent. As the major markets shut down, the spread would consistently widen, sometimes jumping by 30-50% compared to Friday’s close. This isn’t just a tiny nudge; this is massive if you’re swapping thousands.

So why the hike? It boiled down to two things I kept circling back to: lack of participants and risk premium.

- Lack of Participants: On a Sunday, the big banks, institutional players, and major market makers are taking a break. They are the ones who provide the bulk of the market depth. When they step out, the remaining smaller players—who are still offering a 24/7 service—know they have less competition. They can charge more for the service of finding a counterparty for your swap. Basic supply and demand, right?

- Risk Premium: And this is the sneaky part. Even if the markets are closed, unexpected news can drop—a political crisis, a sudden policy change. If some event happens Sunday night before the Asian markets reopen, the remaining liquidity providers take on a higher risk that the rate might shoot up or down against them before they can hedge their position on Monday. To cover this potential risk, they slap on an extra charge, which you see reflected in the wider spread. They are basically charging you for holding the bag over the weekend.

I confirmed this by talking to a guy I know who runs a small specialized FX desk. He told me straight up, “Look, on Sunday, we’re mostly dealing with emergencies or urgent retail transfers. We staff skeleton crews. We have to make it worth the cost and the headache of being exposed during a non-standard operating time. We widen the spread. Everyone does.”

The solution, if you can wait? Just wait until Monday morning. If you can move your funds or do your swap after London or even New York opens, the sudden influx of market makers and competition forces those spreads back down. I realized my buddy lost a fair bit of cash just because he felt pressured to hit the button on a Sunday night. Now, I preach this to anyone who listens: Unless the world is ending, avoid that Sunday swap trap. It’s just a tax on impatience and market closure.