The Mess I Got Into with Structuring Cash

You know how it is when you’re running a business and cash is king? I had this stretch where a bunch of my clients were paying in actual physical cash. Great for liquidity, bad for trying to look normal to the bank. I mean, we’re talking about hefty amounts, way more than I usually dealt with in bills and coins. I wasn’t doing anything illegal, just good old-fashioned sales, but suddenly I felt like every deposit was under a microscope.

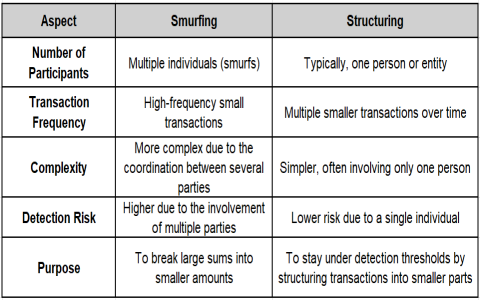

I started getting antsy about the whole reporting thing. I knew banks had to report large cash transactions, the Bank Secrecy Act stuff. I didn’t want the hassle, the paperwork, or frankly, the scrutiny. My books were clean, but who needs the government peering over your shoulder? So, I got this bright idea, this really dumb idea in hindsight: I’d “structure” the deposits.

The Slippery Slope

My first attempt was simple. I had about $15,000 in a safe. I figured, instead of dumping it all in at once and hitting that $10,000 threshold, I’d split it up. I walked into the bank on Monday, deposited $7,500. No big deal, right? The teller just processed it, smiled, and everything seemed fine. Felt like I’d dodged a bullet.

The next day, I went back and put in the remaining $7,500. Still under the limit. I thought, “This is brilliant! Why did I worry so much?” I did this a few more times over the next few weeks with different bundles of cash coming in. Sometimes I’d use two different branches. Sometimes I’d wait a few days in between. I was being super careful, making sure no single deposit hit five figures. I genuinely thought I was being clever, just managing my finances efficiently.

- Split a $12,000 payment into two $6,000 deposits.

- Used two different banks for a large amount from a single project.

- Waited exactly two days between smaller deposits, just to space them out.

It went on like this for about a month. I felt like a financial ninja, staying under the radar. My confidence was building, and I was starting to see this practice as just part of my routine cash management.

The Knock on the Door

Then, the music stopped. About six weeks after I started this structural gymnastics, I got a call from my bank manager. Nothing major, just a casual “Hey, can you pop in and discuss your recent activity?” I played dumb, “Sure, is something wrong with the account?”

When I walked in, it wasn’t just the bank manager. There was a guy in a relatively cheap suit who introduced himself vaguely, but his ID tag was enough to make my stomach drop. FinCEN. They weren’t there to congratulate me on my detailed accounting. They were there because they noticed my pattern.

The agent didn’t even need to pull out a big fancy graph. He just laid out the dates and amounts. “Mr. [My Name], we’ve observed several deposits that appear to be intentionally structured to avoid triggering Currency Transaction Reports.” The term “structuring” hit me like a ton of bricks. It wasn’t just frowned upon; it was illegal, a federal crime, even if the underlying money was legit! I was busted not for the cash itself, but for how I handled the deposits.

I stammered, tried to explain it away as just trying to manage my busy schedule and making deposits when I had time, but the agent was having none of it. They could see the consistent pattern of deposits just under $10,000. It was obvious, mathematically obvious, what I was doing.

I spent the next two hours sweating through my shirt, trying to explain that the money was all from legitimate business operations—which it was—and that I was just trying to avoid “unnecessary red tape.” The agent made it clear: avoiding “unnecessary red tape” when it comes to reporting is exactly the crime. They treat it seriously because structuring is a massive red flag for things like money laundering and drug trafficking, even when you aren’t doing those things.

They didn’t arrest me on the spot, thank God, but they froze a good portion of the money involved in the structuring attempts while they investigated the source. The legal fees to prove the legitimacy of the money and deal with the structuring violation were insane. The investigation dragged on for months.

The lesson I took away? Just make the big deposit. File the paperwork. Deal with the minor inconvenience of a CTR. Trying to outsmart the system by structuring deposits is way more dangerous and costs infinitely more time and money than just being upfront from the start. Never again will I try to play cashier cat and mouse with the Feds.