My Deep Dive into the Currency Exchange Scam

So, I’ve been messing around with international payments a lot lately, moving money between accounts in different countries, and man, did I get hit with some annoying realization. You know how banks advertise “zero fees” or “low cost” for foreign exchange? Yeah, that’s a load of crap. They’re just hiding the fee right in front of your face.

I started this whole thing when I was trying to pay for something overseas. I checked the spot rate—the real rate you see on Reuters or Bloomberg—and then I looked at what my bank was offering me. The numbers were off. Not a huge amount, but consistently off. I first thought, okay, maybe it’s just a tiny processing thing, nothing to worry about.

But then I started logging every single transaction I made. I pulled up my statements, checked the day’s mid-market rate (the real one), and compared it to the rate they actually gave me. I used a simple spreadsheet to track the difference. I was converting US dollars to Euros, and back again sometimes, just to see the symmetry of the rip-off.

Tracking the Spread

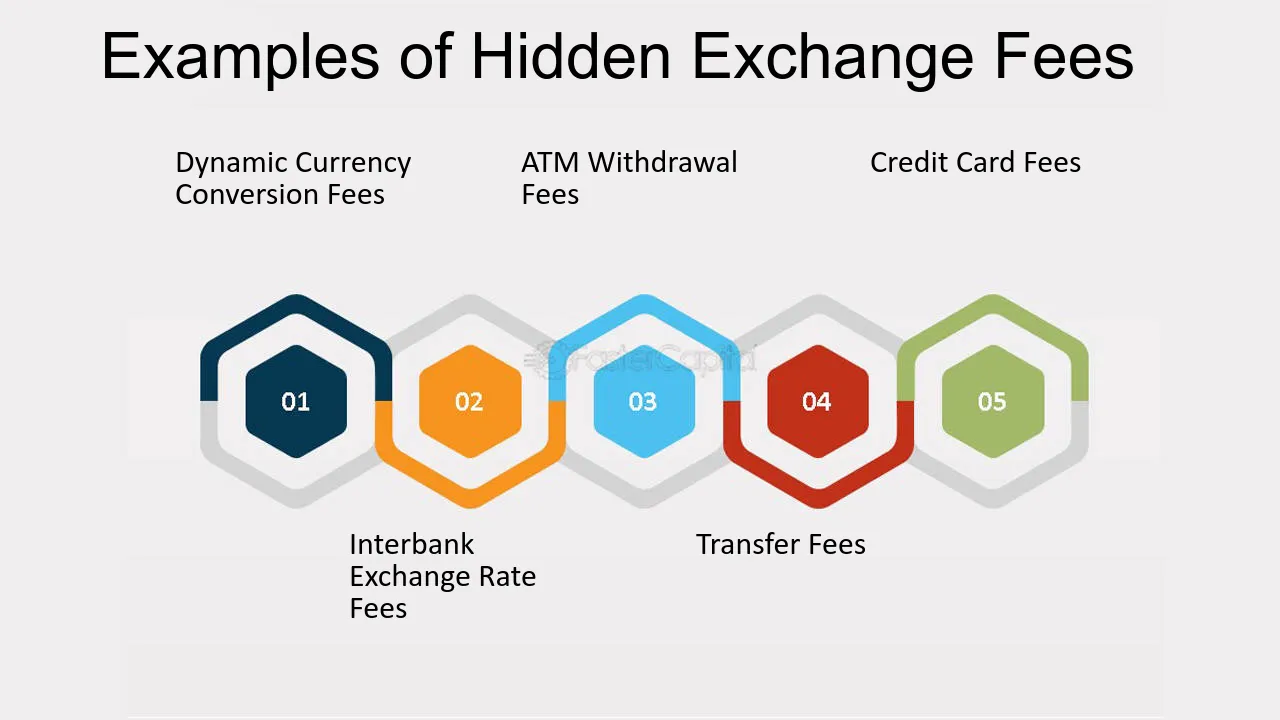

What I found out is what they call ‘the spread.’ Basically, when you convert USD to EUR, the bank buys the EUR from you cheaper than it sells it back to you. They set their own buy rate and sell rate, and that margin is pure profit for them. It’s stealth income, and they never call it a ‘fee’ because technically, it’s not a separate charge.

- I began by looking at small amounts, like $100 conversions. The difference usually looked like just a few cents per dollar. Easy to ignore.

- Then I tried bigger conversions, like a couple thousand dollars. Suddenly, those few cents multiplied, and I was losing maybe $30 or $40 dollars on a single transaction without even seeing a line item fee.

- I even tested different times of the day. Nope, didn’t matter. The spread was baked in, constant, maybe slightly fluctuating, but always favoring the bank.

I distinctly remember one conversion where I needed to move about five grand. The spot rate was something like 1.08 USD per EUR. My bank gave me 1.095. That seemingly small difference meant I received substantially less Euros than I should have. I felt cheated, honestly, because I had specifically chosen a bank that bragged about low FX costs.

The “Hidden Fee” Revelation

I started digging into the fine print—that horrible, microscopic text everyone ignores. Turns out, they vaguely mention that the rate provided includes a ‘margin’ but they never, ever quantify it. It’s super vague language.

I even called up customer service, pretending to be clueless, asking why their rate wasn’t exactly the Google rate. The representative just mumbled something about “market volatility” and “operational costs.” Total smokescreen. They wouldn’t admit they are intentionally marking up the rate to pocket the difference.

What I Started Doing Instead:

After realizing how much I was hemorrhaging just in the spread, I started testing alternatives. I tried a few smaller fintech companies and specialized money transfer services. Holy cow, what a difference.

These smaller players operate on much tighter spreads. They usually give you a rate that’s much, much closer to the mid-market rate, and then they charge a very small, explicit fee. I found that even with that visible fee, the total cost was significantly lower than the bank’s hidden spread.

I ran a side-by-side comparison on a $10,000 transfer:

Bank: Advertised 0% fee, but the spread cost me about $180.

Fintech Service: Charged a $20 flat fee, and the spread cost me maybe $50.

The banks are slick, right? They make you feel good by saying “no foreign transaction fee,” and you overlook the fact that they just stole the money from you by manipulating the exchange rate. It’s not illegal, but it sure feels sneaky. Now, I always check the spot rate right before a transfer, calculate the expected amount, and if the quoted rate from any provider is too far off, I just walk away. It’s the only way to beat their game.