Friendly Fraud: Dealing with Customer Chargebacks

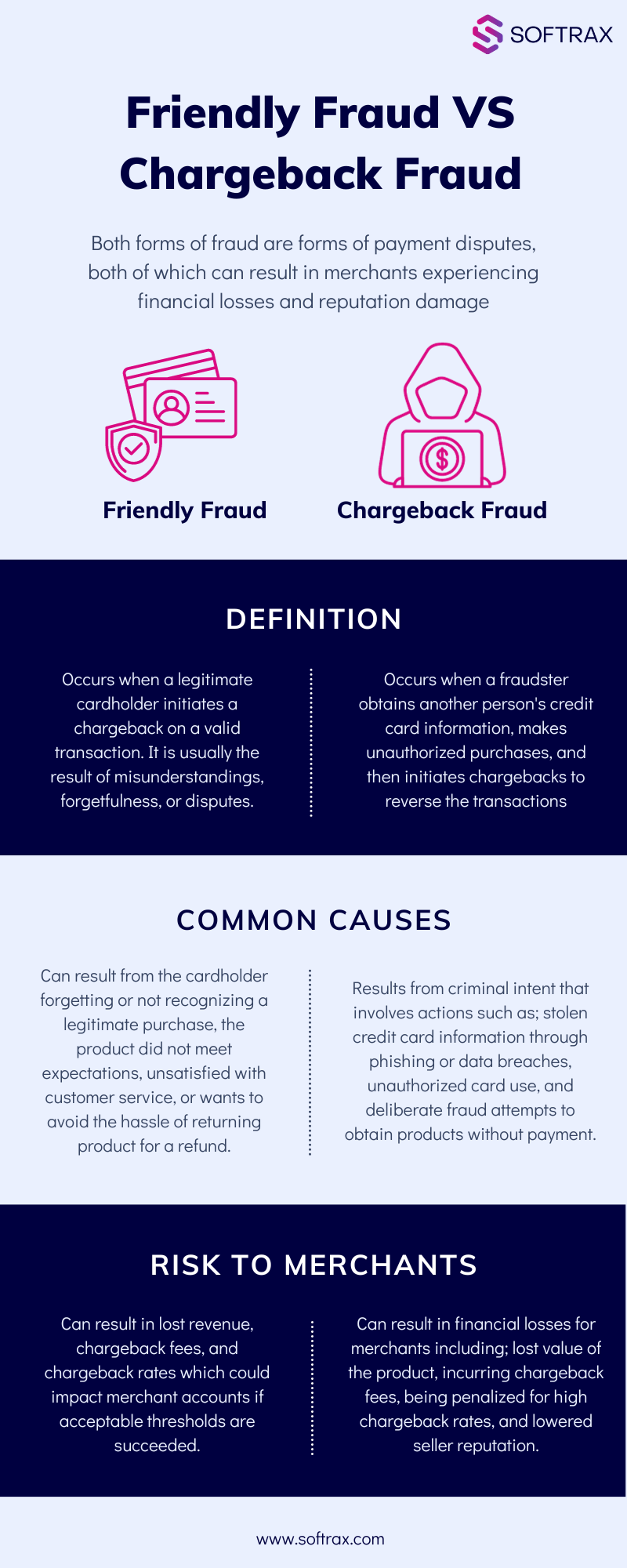

Man, dealing with ‘friendly fraud’ is just the worst. It’s what happens when a customer buys something, gets it, and then tells their bank that they never authorized the purchase. Basically, they get to keep the goods and I have to give the money back. It’s a total kick in the teeth for a small business owner like me.

I started noticing this trend ramp up maybe two years ago, particularly around high-value items. At first, I just thought it was a genuine mistake—maybe someone’s kid used their card, or a spouse didn’t realize the purchase was legit. I’d try to reach out, send them the receipts, the tracking info, everything. Most of the time, they’d just ignore me or, worse, double down on the claim. That’s when I realized this wasn’t accidental; it was malicious, or at least, intentionally misleading.

Initial Steps: Getting the Paperwork Straight

The first few times I got hit, I lost immediately because I didn’t have my ducks in a row. The banks always side with the consumer unless you provide rock-solid proof. So, I completely revamped my record-keeping process. Now, every single order, even the small ones, gets meticulous documentation.

- Detailed Proof of Delivery (PoD): I shifted carriers to ones that provide photo evidence of delivery, not just a signature. Signatures are easy to dispute. A photo of the package on their porch? Much harder to argue against.

- IP Address Tracking: When an order comes through, I record the IP address and make sure it matches the billing location, or at least the general area. If a chargeback hits, this is the first thing I present. It shows the transaction wasn’t initiated from some random place across the globe.

- Communication Logs: Every email, every customer support chat, even automated ‘order shipped’ notifications—they all get bundled up. If they interacted with us after the purchase, saying something like, “Thanks, I love it,” and then file a chargeback, that email is golden.

I learned quickly that volume matters. If the customer has multiple successful transactions with me over a year, and then suddenly disputes one, I highlight that history. It makes the fraudulent claim look even weaker to the bank.

Fighting the Disputes (Representment)

The representment process is tedious, but you gotta do it. When the bank hits me with a chargeback notification, I don’t just eat the loss anymore. I gather up my evidence bundle—usually a PDF packet 10-15 pages thick—and send it back to my payment processor.

My strategy is simple: make it impossible for the bank to ignore the facts. I use bold text, clear headings, and literally reference the customer’s purchase history and communication logs right next to the delivery confirmation. I don’t try to be emotional; I stick strictly to timelines and data points.

The Turning Point: A Case Study

I had one recent case where a customer ordered a relatively expensive electronic gadget. They confirmed receipt via chat and even asked a technical question about using it. Three weeks later, BOOM, chargeback: “Unauthorized Transaction.”

I immediately pulled the data. I had the IP matching their home state, the photo PoD showing the package on their identifiable front stoop, and most importantly, the chat log where they confirmed they had the item and were actively using it. I sent all of it back in the representment. I even added a note pointing out the dates—showing they were using the product after the claimed unauthorized purchase date.

It took six weeks, but I won. The bank reversed the chargeback in my favor. That victory, honestly, felt huge. It showed that my meticulous documentation was worth the effort.

Long-Term Strategy: Screening and Software

I’m now running all new orders through an advanced fraud detection tool. It costs a bit more per month, but if it flags an order as high-risk (maybe a new card with a high transaction value, shipping to an address different from billing), I don’t just ship it. I contact the customer directly—a quick phone call or a detailed email asking them to verify something simple. If they balk or don’t respond, I cancel and refund the order immediately. Better to lose a sale than lose the product and the money to friendly fraud.

It’s a nasty part of doing business online, but if you treat every transaction like it might be disputed, you stand a chance to fight back and win.