So, you think having just one bank account is fine? Nah, trust me, you’re setting yourself up for trouble. I learned this the hard way, and let me tell you, it was a proper nightmare. That’s why I banged out this whole thing about needing two bank accounts, minimum.

The Nightmare Start

A few years back, I was like everyone else, chucking all my money into one main checking account. Easy peasy, right? Then, one day, I was trying to pay a big bill—rent, I think—and my card got declined. I thought, “What the heck? I know I have the money.”

- Tried the ATM. Denied.

- Tried another online purchase. Denied.

- Checked the app. Couldn’t even log in properly.

I called the bank, and they hit me with the usual corporate nonsense: “security review,” “suspicious activity,” and all that jazz. They had frozen my entire account. Everything. My savings, my checking, all locked down tighter than Fort Knox.

I was furious. I spent three days on the phone, passing security checks, sending ID copies, waiting for managers to call me back. Meanwhile, bills were piling up. I had zero access to my own money. Literally stranded.

The Scramble for Cash

That immediate moment of panic? It was rough. I couldn’t buy groceries. I couldn’t put gas in the car. I had to beg a friend to spot me some cash just to survive until the bank unfroze my funds. It was embarrassing, stressful, and totally unnecessary if I had been smarter.

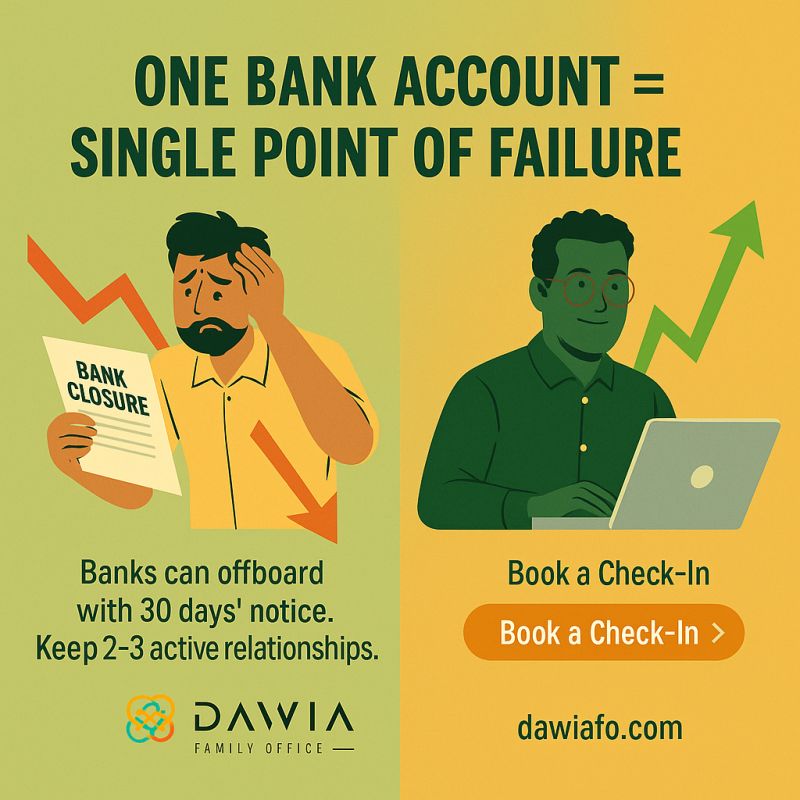

This whole mess hammered home the concept of a Single Point of Failure (SPOF). If one system goes down, everything stops. My single bank account was my financial SPOF.

Once the dust settled—it took almost a week, mind you—I vowed never to let that happen again. I immediately started the process of diversifying.

The Implementation: Diversification Strategy

I realized I needed a ‘break glass in case of emergency’ account. Not just a separate savings account at the same bank—because if they freeze the whole damn profile, the savings go too—but an account at an entirely different institution.

Step One: Picking the Second Bank

I looked for one that was reliable and had zero fees, preferably an online bank since they often offer better interest rates anyway. I didn’t want any hassle, just a reliable backup vault.

Step Two: The Setup

I opened a new checking account and a small associated savings account there. This account became my dedicated emergency fund and buffer zone. I set up a small automatic transfer every payday—nothing huge, just enough to keep it funded.

Step Three: The Allocation Rule

My main bank account still handles the big stuff: direct deposits, mortgages, utility payments. My second, smaller bank holds about a month’s worth of expenses, plus my true emergency savings. If Bank A screws up, I can instantly switch over to Bank B’s debit card and pay bills from there while I sort out Bank A.

I even tested the transfer process between the two banks to make sure it was fast and reliable. I wouldn’t trust it if I hadn’t seen the money move smoothly myself.

Why Two Accounts Solved Everything

This simple switch completely changed my financial security. If Bank A has an IT meltdown, a fraud alert, or locks me out, I simply move my spending to Bank B. The system works because the risk is spread out.

I’m not relying on one IT department, one security team, or one set of rules. It’s like having two keys to your house, or a spare tire. You don’t need it until you REALLY need it, and when that moment comes, you’ll be patting yourself on the back.

Honestly, stop putting all your eggs in one basket. Just open that second account. It’s boring, but it might save your butt when everything else goes south