“Your Funds Are Frozen”: Surviving the PayPal 180-Day Hold

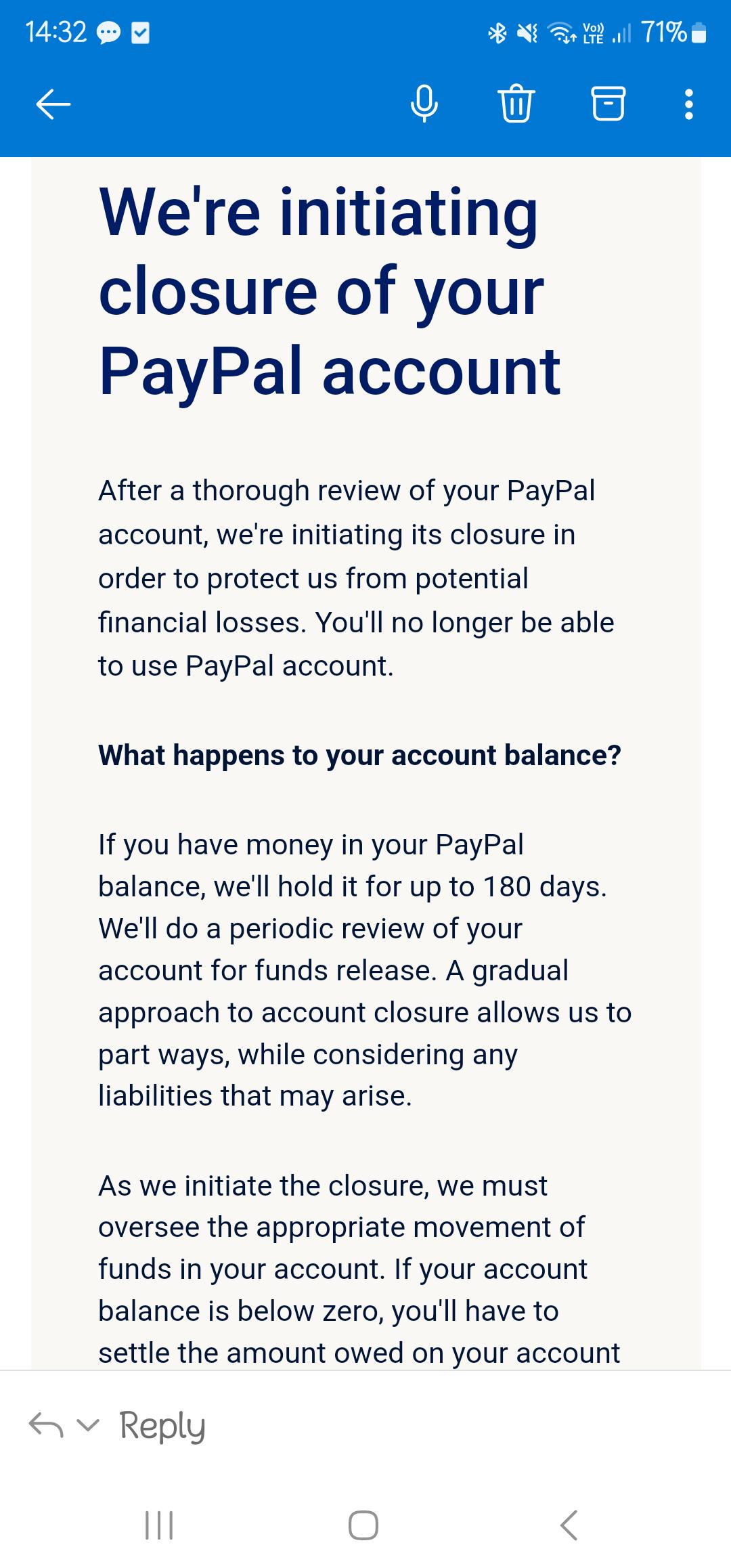

Man, dealing with PayPal is always a headache, right? So I’m running this small side hustle, mostly selling vintage tech parts online—stuff I pick up cheap at estate sales, fix up a bit, and flip. Things were cruising along nicely; moving maybe a couple thousand bucks a month through PayPal. Then BAM! One morning, I log in and see the dreaded message: “Your account access is limited. Funds are subject to a 180-day hold.”

I swear my stomach just dropped. A hundred eighty days? That’s six months! They had about $1,500 of my hard-earned cash just sitting there, locked away. My first thought was, “What the heck did I do?”

I immediately dove into their Resolution Center. Their official reason? “Suspicious activity due to rapid volume increase.” Which is total nonsense. I was just selling more stuff because I found a few really good deals. It wasn’t ‘suspicious,’ it was ‘successful.’ But try telling that to their automated system.

The First Phase: Panic and Phone Calls

I spent the whole first day trying to call them. I went through their stupid automated menus like ten times. When I finally got a human, they were absolutely useless. They just recited the same line: “Security protocol, high risk, 180 days.” They wouldn’t even look into the specific transactions. It was just a brick wall.

- Wasted hours on hold.

- Spoke to three different reps, all giving identical canned responses.

- Got zero actionable advice on speeding up the review.

My funds were basically hostages. I knew I couldn’t rely on that money for operational costs, so I had to scramble. I instantly stopped listing new items that required PayPal as the primary payment method. That was my first immediate action—pivot away from PayPal dependence.

The Strategy Shift: Documentation is Key

Since customer service was a dead end, I went deep into documentation. I figured if they wanted ‘proof’ I was legitimate, I’d drown them in it.

I started compiling every single invoice, shipping receipt, and tracking number from the last three months. I also took photos of my inventory—piles of old circuit boards and retro keyboards—to show that I actually had physical goods matching my sales.

I uploaded all of this documentation through their secure message center, basically a massive dump of evidence proving I was a real person running a real business. Did it help immediately? Nope. But I wanted a paper trail in case I needed to fight this legally later.

I also updated all my existing buyers whose payments were tied up. I sent them polite messages explaining the delay (without blaming PayPal specifically) and ensured every single package had tracking and was delivered ASAP. My main concern was chargebacks, which would just make the situation infinitely worse.

The Long Wait and The Lessons Learned

The 180 days was a brutal waiting game. Every few weeks, I’d check the account, just to see the same frozen message. I used this time to diversify my payment processing completely. I opened accounts with a couple of direct bank transfer services and started pushing customers toward those methods aggressively. My listings now prominently featured alternatives. PayPal became the absolute last option.

When the 180th day finally rolled around, I logged in fully expecting another fight. Surprisingly, it was smooth. The hold lifted automatically, and the balance was available to transfer. I didn’t waste a second. I instantly withdrew every penny.

What did I learn from this mess?

- Never trust a single platform with a significant portion of your operating cash. Diversify, diversify, diversify.

- Keep meticulous records. Every receipt, every tracking number—it’s your shield against arbitrary platform decisions.

- When you get hit with the hold, stop arguing and start documenting. The reps can’t help, but the paperwork might save you later.

Now, I still use PayPal occasionally, because it’s a necessary evil for some buyers, but I treat it like a hot potato. Money comes in, and money goes out immediately. I refuse to keep a balance there. My goal now is to keep my financial footprint so tiny on platforms like that, that if they ever try to freeze me again, they’re only grabbing ten bucks, not fifteen hundred.