Alright, let’s talk business accounts, specifically the Airwallex versus Barclays head-to-head I just went through. Honestly, opening a new business account is never fun, but it’s a necessary evil, especially when you’re trying to keep international payments smooth and fees low.

The Setup: Why I Needed a Change

I’ve been using Barclays for my main UK business account forever. It’s solid, reliable—the big bank experience. But man, those international transfer fees were starting to bite, and the exchange rates? Not great when you’re dealing with a decent volume of cross-border stuff. I kept hearing chatter about these fintech players, and Airwallex kept popping up, mainly for their multi-currency accounts and low FX costs. So, I figured, let’s test it properly. I needed something that could handle UK operations while making life easier for payments to our suppliers in the US and Europe.

Barclays: The Old Guard Experience

With Barclays, everything felt heavy and slow, which is expected, right? Getting the account initially was a hassle—lots of paperwork, in-person verification, and waiting around. Once it’s set up, the online banking portal is… okay. It does the job. Direct debits? Fine. UK transfers? Instant. But the moment I wanted to send a non-GBP payment, the process immediately got complicated.

- I had to dig around for SWIFT codes and intermediary bank details.

- The fees were transparently high, but the hidden cost was the awful exchange rate they baked in. It ate into my margins every single time.

- Customer support? If it wasn’t a standard query, expect to be on hold for ages or transferred multiple times.

It’s secure, definitely. But agility and cost efficiency for international trade? Forget about it.

Airwallex: Jumping into Fintech

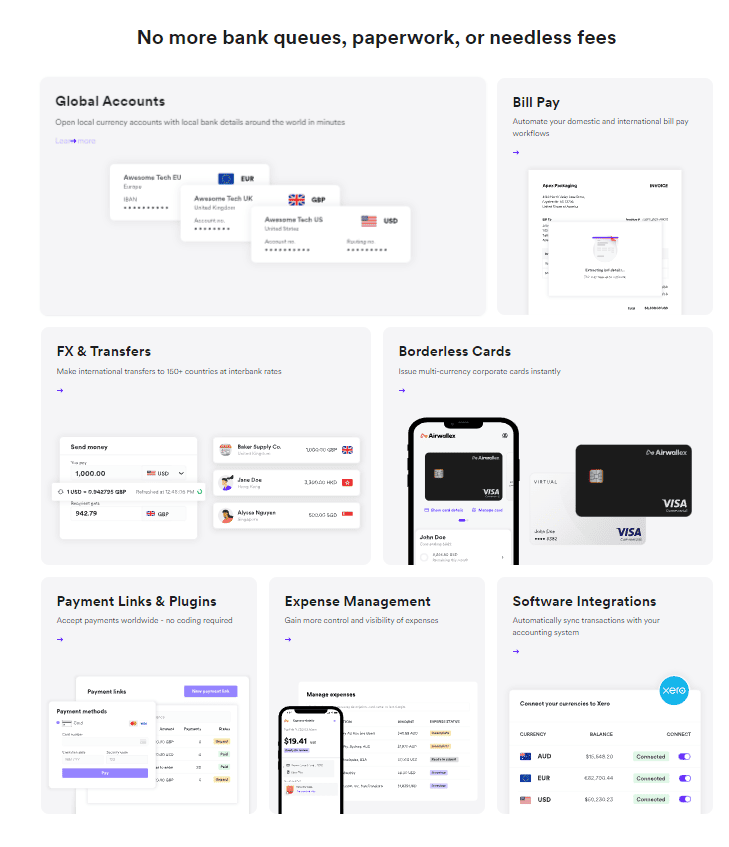

I signed up for Airwallex mainly to use it as a secondary account for international payments, hoping it would save me money. The onboarding process was ridiculously quick. I did it all online. Uploaded documents, a quick ID check, and within a day or two, I had the account fully functional. No branch visits, no endless forms.

The first thing I did was set up a USD account within Airwallex. This was a game-changer. I could receive USD payments from US clients directly without forcing an expensive conversion into GBP first. When I needed to pay my US suppliers, I used the funds already held in USD.

Testing the Transfer Speeds and Costs:

I ran a few trial transfers. Sending £5,000 to a euro account:

- With Barclays, the fee plus the spread meant I lost a noticeable chunk, and the transfer took two full business days to settle.

- With Airwallex, the fee was minimal, the rate was near mid-market, and the transfer, depending on the route, often settled within hours, sometimes instantly to certain EU banks.

The interface is clean and super easy to navigate. Converting funds between my various currency wallets (GBP, USD, EUR) was instant and the rates were clearly displayed, no guesswork or hidden buffers.

The Deciding Factor: Integration and Control

What really won me over with Airwallex wasn’t just the low fees; it was the control. I can issue virtual cards for team members for specific international spend limits instantly. Integrating it with my accounting software (Xero) was flawless, something that always felt clunky with the Barclays feed.

Barclays is still necessary for things like loans or complex local banking needs—the sheer weight of a major high street bank still counts for something. But for day-to-day operations, especially anything involving a different currency, Airwallex absolutely crushed it.

I’ve completely shifted all my foreign currency receivables and payables over to Airwallex. Barclays is now purely for domestic UK bulk payments and holding statutory reserves. If you run a business that deals with any international flow, dropping the legacy bank for international needs is just a no-brainer for cost savings and speed. The testing phase is over; Airwallex is now fully integrated into the workflow.