Picking the Right Bank for My Small Business

Okay, so I’ve been running my little online shop for a few years now, and dealing with international payments has always been a headache. I’m talking about paying suppliers in China and getting money from customers scattered across Europe. I started with my regular old Chase Business account because it was easy, you know? Just walked into the branch and opened it up. But man, those foreign exchange fees started eating my profits alive.

The Chase Experience: Familiar but Costly

I stuck with Chase for a long time because it felt safe. Everything was local, and I could pop down to the ATM whenever. But when I looked closely at my monthly statements, especially the transactions where I converted USD to RMB or EUR, I was shocked. Chase’s FX rates? They were terrible. They tack on a huge spread, and then there are the transfer fees on top of it. It was usually like a 3% hit on every single payment. When you’re dealing with thousands of dollars a month, that adds up fast.

- The Good: Super easy setup, familiar platform, lots of physical branches.

- The Bad: Awful FX rates, high transfer fees for international wires, and customer service that felt like navigating a maze if the issue wasn’t standard.

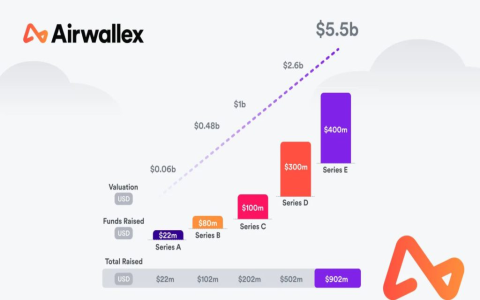

Hunting for Alternatives: Enter Airwallex

I realized I needed something built for cross-border trade, not just domestic checking. I started asking around in some entrepreneur forums, and Airwallex kept popping up. I checked out their website and the whole pitch was about low FX fees and holding balances in multiple currencies. Sounded like exactly what I needed.

Setting up the Airwallex account was purely online, which was a bit different from Chase. Took about a week for verification because they needed all the business docs, tax IDs, the usual stuff. Once I was in, I immediately tested a small transfer.

The Real Test: Fees and Exchange Rates

This is where the rubber meets the road. I did a side-by-side comparison on a $5,000 transfer to my supplier in RMB.

With Chase Business: I went to initiate the wire transfer. The stated interbank rate was, say, 7.20 RMB to $1, but Chase’s offered rate was 7.05. That’s already a massive difference—they pocketed that spread. Plus, the wire transfer fee itself was $40. Total cost of the transfer was well over $200 just in fees and spread loss.

With Airwallex: I funded my Airwallex USD wallet, and then went to convert it to RMB. Their offered rate was 7.18 to $1—much, much closer to the actual mid-market rate. They charge a tiny percentage for the conversion, sometimes less than 0.5%, depending on the volume. The subsequent transfer to the supplier was often free or a very low flat fee, like $5. The saving on that single transaction was dramatic—easily $150 compared to Chase.

What I really liked about Airwallex was the multi-currency wallets. I opened wallets for USD, EUR, and GBP. Now, when a customer pays me in Euros, it lands straight in the EUR wallet. I can then use that EUR to pay a European supplier without ever touching USD, avoiding two conversions and saving even more.

Switching Gears and the Day-to-Day Grind

I haven’t completely dropped Chase. I still use them for payroll and local expenses because that infrastructure is solid. But for anything international, Airwallex is my go-to. Their platform is a little less polished than Chase’s massive banking app, but it does exactly what I need: cheap, fast cross-border payments. The difference in my bottom line over the last six months has been noticeable. I’m finally keeping more of the money I earn.

If your business involves paying or getting paid internationally often, sticking with a traditional bank just because it’s familiar is a costly mistake. Airwallex proved that specialty fintech platforms absolutely crush big banks when it comes to FX and global money movement. It just took me too long to pull the trigger and make the switch for those international needs.