Airwallex vs. Citibank: Global Reach vs. Agility

So, I’ve been juggling a couple of international payment systems for a while now, trying to figure out which one really stacks up better for a small operation that deals with folks all over. The two main fighters in my ring were Airwallex and Citibank. Man, what a difference in approach they have.

I started with Citibank, obviously. They’re the big guns, the established name. Everyone knows Citibank, right? Opening an account was like navigating an old-school maze. So much paperwork, so many forms to fill out, and the in-person verification process took forever. I remember spending a whole afternoon just sitting in their office, waiting for some manager to sign off on a single piece of documentation. It was slow, cumbersome, and felt like they were doing me a huge favor by letting me bank with them.

The good side of Citibank? Their global reach is enormous. When I needed to send money to some really obscure places—think places where even PayPal struggles—Citibank almost always had a correspondent bank. The transfers were secure, no doubt about it, and when the money finally landed, everyone trusted the name on the receipt. That trust factor is massive, especially when you’re starting out. I relied heavily on their vast network, especially for large, infrequent transfers where security was paramount.

But then the fees started kicking in. Holy cow. For frequent, smaller transactions, Citibank was eating my profits alive. The foreign exchange rates were decent, but all the hidden transfer fees and intermediary bank charges? Brutal. I tried talking to my account manager about a better rate structure, and it felt like pulling teeth. They were inflexible; it was their way or the highway.

That rigid structure eventually drove me away. My business started needing more frequent, smaller payments across various currencies, and I needed something faster and cheaper. That’s when I stumbled onto Airwallex.

Switching to Airwallex was like stepping out of a dusty old library into a clean, digital office. The onboarding process? I signed up online, uploaded a few documents, and I was verified within a day. No sitting around in waiting rooms. It was quick, agile, and totally painless. They felt like they actually wanted my business.

The first thing that blew me away with Airwallex was the multi-currency accounts. Setting up a local currency account in USD, EUR, AUD—it was instant. This cut down on so many unnecessary conversion fees right off the bat. When clients paid me in their local currency, it landed directly into that specific currency wallet. No immediate conversion loss, which was a game-changer for my bottom line.

The sheer speed of transactions was the second massive win. Sending money via Airwallex felt almost instantaneous, especially to major territories. Citibank transfers often took 3-5 business days; Airwallex transfers often cleared within hours, sometimes minutes, using local rails. This agility is what I really needed. When I’m paying a contractor overseas, they want their money fast, not next week.

However, Airwallex isn’t perfect, and this is where Citibank still holds a slight edge. Airwallex’s global reach, while impressive and constantly expanding, still hits a wall in those truly niche, hard-to-reach countries. A few times, I had to revert back to my old bank because Airwallex simply didn’t have the payout capability in that specific region. It’s rare, but it happens. And sometimes, their customer service, while mostly helpful, felt a little less ‘personal’ than having a dedicated, albeit slow, Citibank relationship manager.

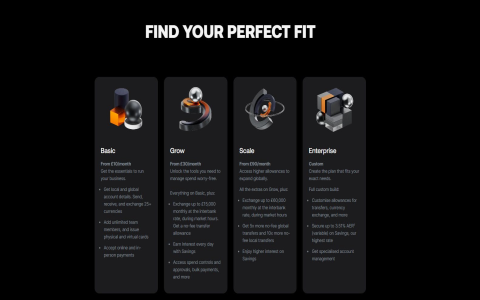

So, the takeaway from this whole experiment? Citibank is the reliable, but expensive, luxury cruise ship—it gets you everywhere eventually, very securely. Airwallex is the fast, efficient speedboat—agile, cheaper, and perfect for daily maneuvers, but maybe not built for every single corner of the globe. For my current operation that values speed and cost-efficiency above all else, Airwallex has become my daily driver. I keep the Citibank account open, begrudgingly, only for those odd, super traditional banking needs or when I need to transfer funds to the deep reaches of the world where fintech hasn’t quite landed yet. Agility definitely wins for the hustle.