The “Dynamic Currency Conversion” Scam: Don’t Click YES

You know, I’ve been traveling for ages, and I thought I had seen every trick in the book. Especially when it comes to money. But this Dynamic Currency Conversion (DCC) thing? It just keeps popping up and honestly, it’s a total ripoff. I decided to finally track my own numbers and see exactly how much cash these guys skim off the top. Spoiler alert: it’s enough to annoy you.

It started when I was grabbing dinner in Rome. I handed over my US credit card—a good one, low foreign transaction fees, maybe 1%—and the waitress brought over the terminal. Now, this is where they get you. The screen immediately flashed two options: either pay in Euros (the local currency) or pay in US Dollars (my home currency).

I instinctively knew better, but for the sake of this little experiment, I clicked the trap. I selected USD. The total popped up: €150.00 became $165.00. I tapped my card, grabbed my receipt, and walked out feeling like a chump, but also ready to dig into the details.

My first step was checking the real exchange rate. I immediately pulled up my favorite currency converter app on my phone—the one that uses mid-market rates. At that exact time, the market rate was something like 1 EUR to 1.05 USD. Simple math: €150.00 should have been about $157.50. That’s the real cost if my bank did the conversion.

So, where did the extra $7.50 go? That’s the DCC fee, plain and simple. It’s what the merchant’s payment processor pockets. It’s a completely unnecessary hidden fee disguised as a “convenience.” They are essentially offering you a worse exchange rate, and then often, my own bank still slaps their 1% foreign transaction fee on the USD amount, compounding the misery.

Next, I tried it again at a different spot the next day—a small coffee shop. Small purchase, just €5.00. Again, the machine pushed the DCC option. This time, I stuck to my guns and selected “Pay in Local Currency (EUR).” My card was charged €5.00. When the transaction settled a day later, my bank statement showed the charge: $5.25. The mid-market rate held true, and my bank’s minimal foreign transaction fee was barely noticeable.

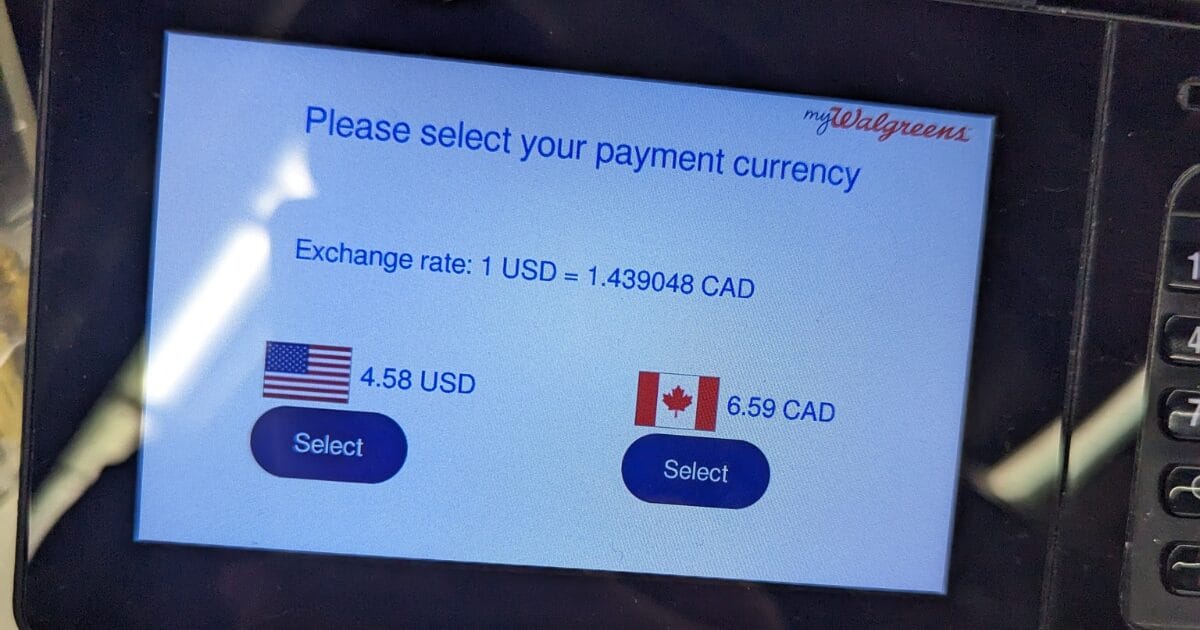

I started tracking every single card transaction over the next week. I kept a running tally, taking pictures of the terminal screen every time they tried to pull the DCC trick. Out of twelve transactions where DCC was offered, selecting the home currency (USD) resulted in an average hidden conversion fee of about 4% to 8% above the actual market rate. Sometimes it was just a few bucks, but on a bigger purchase—like a train ticket—it was substantial. A €300 train ticket would suddenly cost me an extra $15-$20 just for clicking the wrong button.

What I realized is that this isn’t a complex scam. It relies on two things:

- Traveler anxiety: People prefer seeing a familiar currency.

- Machine defaults: Many terminals are configured to present DCC as the big, bold default option.

My final takeaway after this little exercise is concrete: ALWAYS choose the local currency. If you’re in Japan, choose JPY. If you’re in France, choose EUR. Let your own bank handle the conversion, even if your bank charges a small fee. That fee is almost always lower than the massive markup the DCC providers bake into their terrible exchange rates.

I even started telling the cashiers, “Please charge me in local currency,” before I even insert the card. Sometimes they look confused, but I just point to the screen and say, “No, not dollars, Euros.” It’s an active effort, but it saves real money. Don’t fall for the trick. That little click for “convenience” costs you every single time.