Alright folks, time for another deep dive into something I’ve been messing with recently. This time, it’s all about Airwallex and how I’ve been using it to handle payroll for my small but scattered remote team. Specifically, getting those wages out in ten different currencies, which used to be a real pain in the neck.

The Old Way: A Hot Mess of Banks and Fees

Before Airwallex, things were chaotic. My team is spread across Europe, Asia, and a couple of spots in South America. That meant dealing with multiple local banks, each with their own ridiculous transfer fees and conversion rates. I swear, half my finance guy’s week was spent just making sure everyone got paid the right amount, minus the massive bank cuts.

I remember one month, I needed to pay a guy in Polish Złoty and another in Brazilian Real. Two separate wires, two different bank portals, and both times the exchange rate I got felt like highway robbery. Plus, the banks always took forever. Someone in Vietnam would be waiting three days for the money to actually hit their account. It was totally unprofessional and stressful for everyone.

The Search and Discovery

I knew there had to be a better way. I started looking into international payment platforms, avoiding the big traditional players because their fees are just non-starters for a small operation like mine. I needed something that offered good rates and, crucially, multi-currency accounts without needing to open forty different bank accounts.

I stumbled upon Airwallex after a few recommendations in some startup forums. What caught my eye immediately was the ability to open virtual accounts in dozens of currencies. This meant I could essentially receive and hold money in the currencies my team needed to be paid in, minimizing conversion headaches.

Setting Up the Payroll System

The setup process was surprisingly smooth. I signed up, did the standard KYC (Know Your Customer) dance, which took a day or two, and then immediately started setting up my currency wallets. I focused on the ten currencies I needed: USD, EUR, GBP, AUD, HKD, SGD, CAD, PLN, BRL, and PHP. It felt great just seeing those accounts linked up.

The real shift came when I linked my primary business bank account (in USD) to Airwallex. Instead of wiring money directly to ten different foreign accounts, I just funded my Airwallex USD wallet. Then, I used their built-in conversion feature.

Step-by-Step Execution:

- I calculated the exact local currency amounts owed to each team member.

- I used the Airwallex platform to convert the necessary USD amount into each of the ten target currencies. The rate I got was significantly better than what my main bank ever offered.

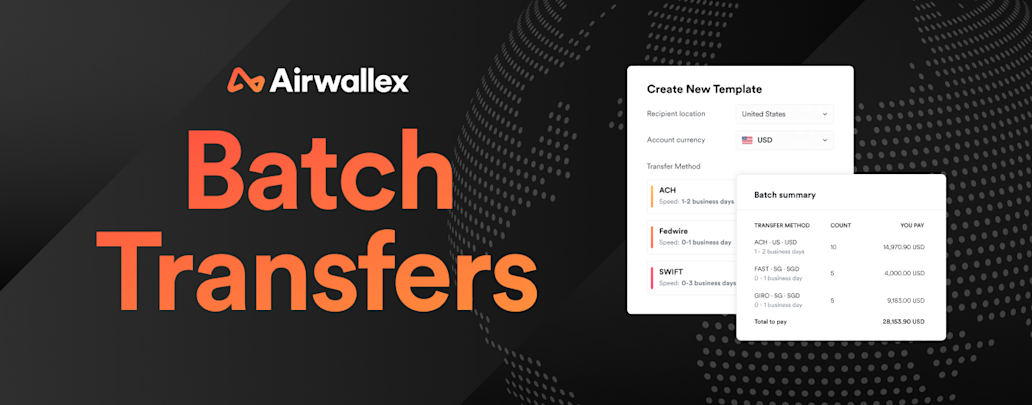

- Once the funds were sitting in the respective currency wallets (e.g., EUR for the German contractor, BRL for the Brazilian designer), I initiated batch payouts.

The batch payout feature is a lifesaver. I uploaded a simple CSV file with the recipient names, bank details, and amounts for all ten currencies at once. Click, approve, done.

Immediate Results and the Time Savings

The difference was night and day. First, speed. Most of the payments, especially those to major jurisdictions like the EU or UK, landed within hours, sometimes instantly via local clearing networks that Airwallex uses. The remote team members noticed this immediately. No more waiting around, which is a huge boost to morale.

Second, the cost savings were huge. By using Airwallex’s interbank rates, the cumulative fees and margin I saved each month easily covered any transaction fees they charge. We’re talking thousands saved over the course of a year, which for a small business is real money.

Now, payroll day takes about 30 minutes. Log in, check the rates, perform the necessary conversions, upload the batch file, and hit send. It’s consolidated, fast, and transparent. I can see exactly what everyone is getting and what the true cost is, no hidden bank fees cropping up a week later.

For anyone running a truly global remote team, getting off the traditional banking system for payroll is a game-changer. Airwallex just streamlined a massive headache for me, allowing us to pay people correctly and quickly, regardless of which currency they operate in.