Jumping into Multi-Currency Accounts: My Grind on USD, GBP, and EUR Collections

Man, let me tell you about this recent project. It was all about getting our system solid for multi-currency accounts, specifically dealing with USD, GBP, and EUR collections. Seemed simple on the surface, right? Just three currencies. But oh boy, the rabbit hole went deep.

I started off with the basics. First thing was making sure the account creation flow actually let me pick a non-default currency. Our backend was mostly set up for USD, so I had to tweak the API calls to explicitly pass in ‘GBP’ or ‘EUR’. Initially, there were weird validation errors. Like, it kept insisting the currency code was invalid, even when I was sending the ISO standard codes. Turned out, a lookup table on the database side hadn’t been updated with the new accepted values. Classic oversight.

Once account creation was smooth, I moved onto the actual collection part. This is where things got messy. We use a third-party payment gateway, and integrating multi-currency processing with them always requires a bit of gymnastics.

- USD Testing: This was the easiest. Our standard flow. I created a few test transactions—small amounts, large amounts, refunded them. Made sure the ledger accurately reflected the debits and credits. No surprises here.

- GBP Testing: I hit a snag immediately. When trying to process a GBP transaction, the gateway was rejecting the request, saying the merchant ID wasn’t configured for that currency. I spent half a day coordinating with the ops team to get the appropriate GBP merchant credentials linked up in our configuration service. Once that was done, the processing went through, but the conversion rate logging was bugged. It was pulling an outdated internal rate instead of the real-time rate from the gateway response. Had to fix the parsing logic in the webhook handler to grab the correct conversion info.

- EUR Testing: This was the final frontier. Setting up the accounts worked fine. Processing transactions initially failed exactly like GBP did—configuration issues. After that was sorted, the main issue was reconciliation. When an EUR payment settled, the reported fees were totally off. It turned out our system was calculating platform fees based on the USD equivalent of the transaction at the time of collection, but the gateway was reporting fees based on the final settlement amount in EUR, which was slightly different due to tiny fluctuations. I had to re-engineer the fee calculation module to treat multi-currency fees separately until the final settlement report came in, ensuring we didn’t double-charge or under-report.

The whole process involved a lot of logging and tracing. Every time a collection failed or the final balance looked wrong, I’d dive into the server logs, compare the payload sent to the payment provider versus the webhook response we got back. I’m talking about cross-referencing timestamps down to the millisecond. It was detail work, but essential for financial accuracy.

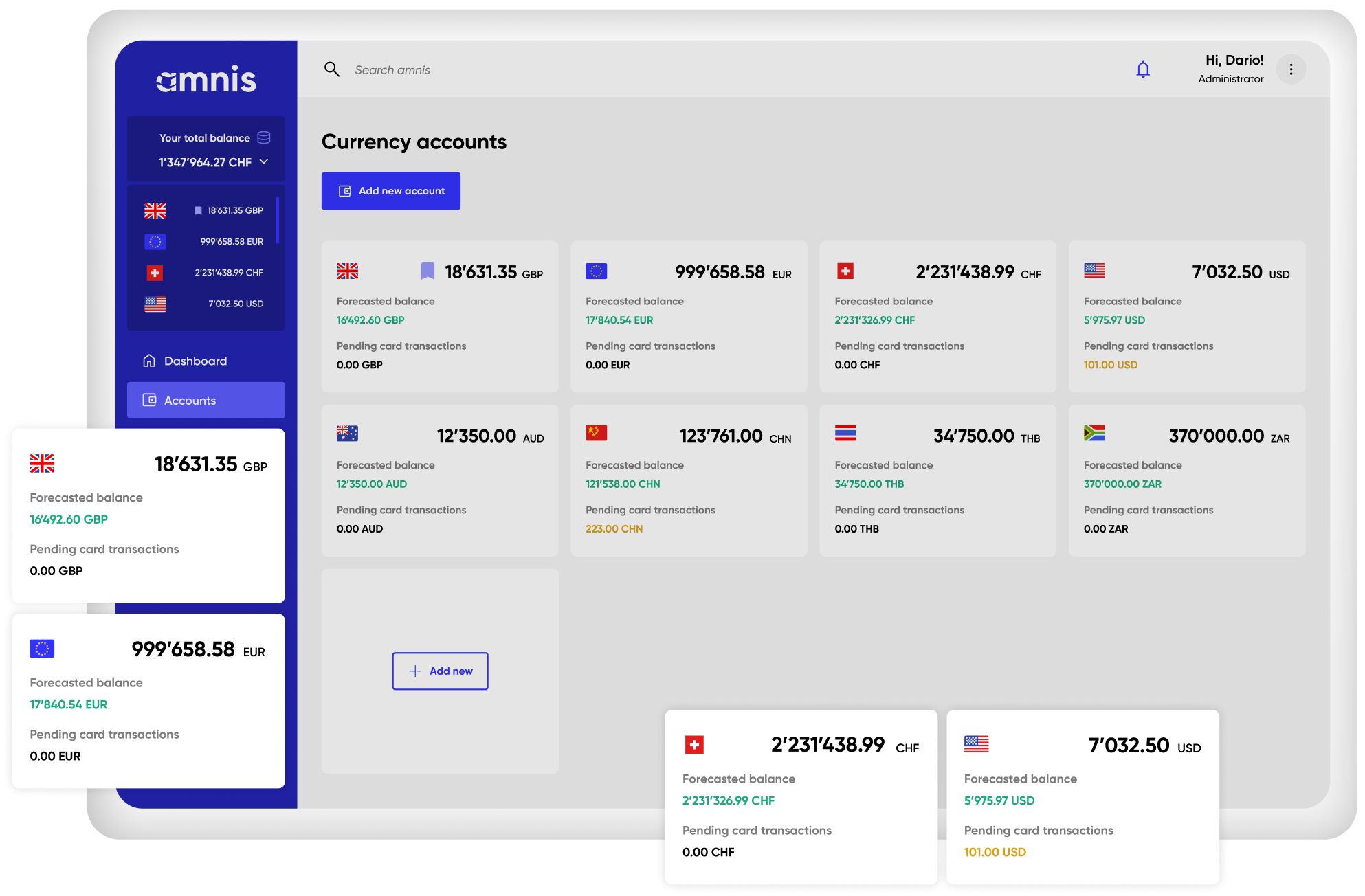

Finally, I had to build some automated regression tests specifically for these three currencies, covering successful collections, failed payments (like insufficient funds or expired cards, all mocked through test tokens), and full refunds. This involved writing scripts that mimic real user behavior, ensuring that even if someone messes with the core code later, these crucial multi-currency flows don’t break. Seeing those green lights for USD, GBP, and EUR collections after weeks of poking and prodding felt genuinely satisfying. Now, if someone wants to add AUD or JPY, we at least have a solid foundation to build upon. Learned a ton about the hidden complexities of managing global money flow, that’s for sure.