Man, what a ride learning about this Sales Tax Nexus thing. I remember feeling totally lost when I first started selling my stuff online outside of my home state. I was like, wait, I gotta pay taxes in places I’ve never even set foot in? Sounds crazy, right?

My journey kicked off about three years ago. I was finally hitting some decent sales volume, and a buddy of mine—who is super into finance and always reading the fine print—pinged me one day. He casually asked, “Hey, are you tracking your sales tax nexus?”

I legitimately thought he was talking about some new sci-fi movie. I told him straight up, “What in the world is a nexus?”

The Deep Dive Into Economic Nexus

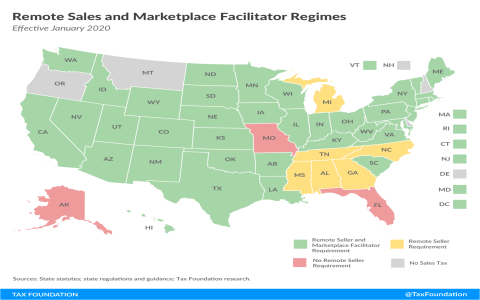

He sent me a link to some state government website—boring stuff, but necessary. That’s when I realized this wasn’t just about physical presence anymore. It wasn’t about having a warehouse or an office in another state. It was about Economic Nexus.

I started digging. I opened up my sales reports from the previous year. I was using a simple e-commerce platform and initially, I was only collecting tax for my home state, assuming everything else was the customer’s problem. Big mistake.

The core issue I ran into was that different states had different thresholds. It wasn’t uniform, which made things a total headache. Some states said if you hit $100,000 in sales OR 200 separate transactions, you’ve established nexus. Other states just cared about the dollar amount.

- I started by listing every state I shipped to.

- Then, I pulled the gross sales and transaction count for each of those states over the past 12 months.

- I had to manually look up the economic nexus threshold for every single one of those states. This part took forever because I was trying to figure out if I crossed that line in states like Texas, California, and New York. Those big ones are usually the first to get you.

I found out quickly that I had definitely crossed the line in two states and was dangerously close in three others. Panic set in. I was technically liable for uncollected sales tax!

Implementing the Solution (and the Cost)

The first thing I did was stop trying to be a tax expert. That was a losing battle. I knew I needed automated software. I looked at a few options, the big names in sales tax compliance. They were expensive, but frankly, paying a subscription fee was way better than risking an audit and massive back taxes and penalties.

I went with a service that integrated directly with my sales platform. It was a game-changer. The setup process required me to input all my current nexus states—the two I found—and then the software automatically calculated the correct rates for every single transaction going forward, based on the customer’s address.

But the tricky part wasn’t the going forward; it was the past. I talked to a tax advisor (yes, I broke down and hired one just for this mess). He advised me on filing Voluntary Disclosure Agreements (VDAs) in the states where I had definitely hit nexus but hadn’t collected tax yet. This basically meant admitting my mistake and agreeing to pay the uncollected tax without them hitting me with huge penalties, usually, they waive most of the penalties if you come forward first.

It was painful. I had to pay out-of-pocket for about six months’ worth of sales tax for those two states because I hadn’t collected it from the customers. It taught me a huge lesson: Always monitor your sales volume and transaction count by state monthly.

Staying Compliant and Avoiding Future Headaches

Now, I check my sales numbers religiously every quarter against those state thresholds. My software automatically handles the calculating and remittance (sending the tax money to the state), but I still have to handle the registration.

Every time I cross a new state’s threshold, I immediately start the registration process to get a sales tax permit for that state. It’s just a few forms online, but you have to do it before you start collecting, legally.

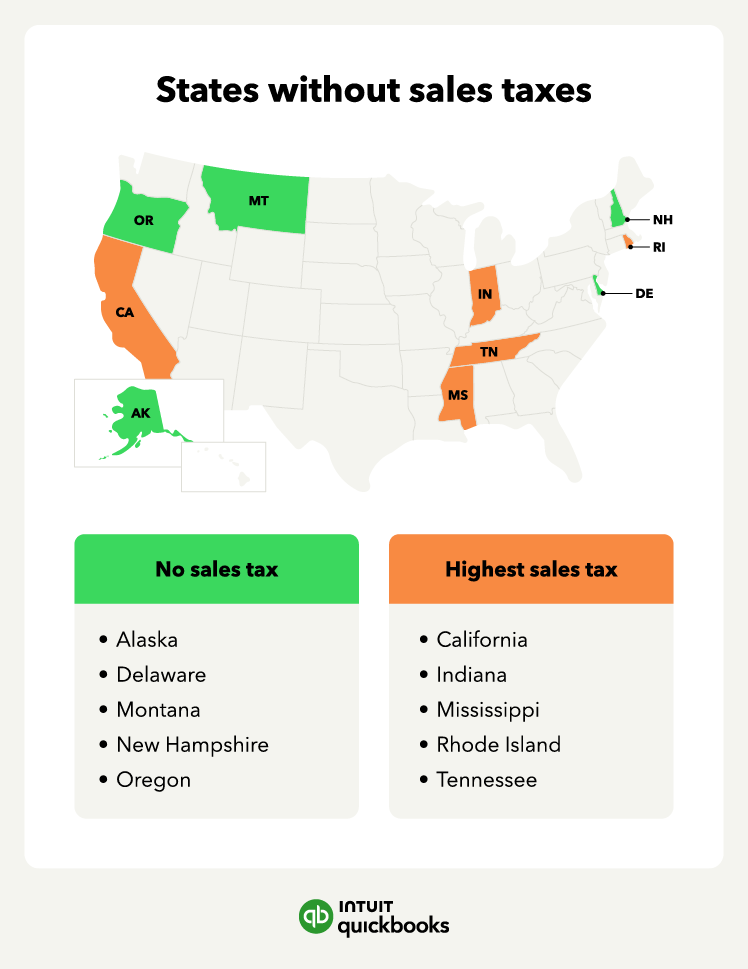

It sounds complicated, and frankly, it is messy because of the 50-state patchwork system we have here. But once you set up the initial systems—the tracking, the software, and the registration process—it mostly runs itself. The key is just not ignoring those sales thresholds. If you’re selling nationally, you are almost certainly going to owe taxes in states you don’t live in. Don’t wait for the audit notice like I almost did!