Man, comparing Airwallex and Divvy, it’s a whole thing. I’ve actually spent the last couple of months diving deep into both of these for my own business expense management, and let me tell you, it was a proper wrestling match.

The Starting Line: Why I Even Bothered

My old system was a mess. Receipts everywhere, constant chasing, and reconciling everything at the end of the month felt like I was solving a complex math puzzle drunk. I needed something integrated, something that just handled the whole expense lifecycle from swipe to ledger entry. I heard good things about both Airwallex and Divvy, so I decided to run a little parallel test.

First up: Getting Set Up.

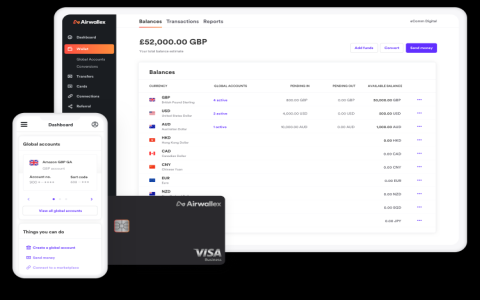

Airwallex was okay, but a bit more geared towards global business right out of the gate. Applying for cards, setting up multi-currency wallets—that was smooth. Their onboarding felt very corporate, very structured. They wanted to see all the papers. Divvy, which is now Bill, was faster to get the cards issued, feeling more small-to-medium business friendly. They were less intense on the initial documentation, which was a plus for speed, but I wondered if that meant less robust security down the line.

- Airwallex: Strong focus on global accounts and FX rates. Took about a week to get fully rolling.

- Divvy (Bill): Quick card issuance, very US-centric initially. Cards were in hand and active within a few days.

In the Trenches: Spending and Capturing Receipts

This is where the rubber meets the road. If the receipt capture sucks, the whole system fails.

I started issuing virtual cards for different departments—marketing spend, software subscriptions, travel. I found Divvy’s budgeting tools immediately more intuitive. You set a budget, assign the card, and once it hits the limit, it’s cut off. Simple, effective control. My team loved it because they knew exactly what they had.

Airwallex’s approach was a bit looser on the budgeting side unless you used their Expenses feature, which felt tacked on rather than native. However, Airwallex nailed the multi-currency spending. If I paid a supplier in Euros, the real-time conversion and clear reporting on the FX spread was excellent. Divvy, while functional for international use, always felt like it was doing a conversion dance to get back to USD, and the fees weren’t always as transparent as I’d like.

Receipt Management:

Divvy’s mobile app was fantastic for receipt snapping. Swipe the card, get the notification, snap the receipt, done. It uses AI or something to autofill the details pretty well. The immediate requirement for receipt submission was key to stopping the backlog.

Airwallex’s receipt matching was alright, but the UI felt clunkier. Sometimes the receipt matching took a minute, and the prompt wasn’t as urgent as Divvy’s. I still had to chase my guys more often using Airwallex.

The Finish Line: Reconciliation and Integration

This is where I decide who wins long-term. Everything has to talk to QuickBooks Online.

Divvy’s integration with QuickBooks was seamless. It pushed the transactions, allowed me to select the category and vendor right there in the Divvy platform, and then synced perfectly. It was built for that US accounting ecosystem. The mapping was easy, and the transaction visibility was spot on. It really cut down my bookkeeper’s workload significantly.

Airwallex, again, shines if you have complex multi-currency needs. When dealing with transfers and multiple currency balances, Airwallex organized that data beautifully. However, integrating the cards and expense management side back into QuickBooks was less straightforward. It required a bit more manual customization of the sync rules, especially around foreign transactions and exchange gains/losses. It’s powerful, but it demands more attention to set up correctly.

The Verdict I Landed On

For my business, which is primarily US-based but does frequent international transactions, the choice boiled down to ease of use versus global depth.

I ended up leaning towards Divvy (Bill) for the daily expense management and control. The intuitive budgeting and superior receipt capture directly translate to less administrative headaches for everyone. It solved my main pain point: getting timely and accurate expense data.

I still keep Airwallex for large volume international payments and holding balances in different currencies because their FX rates beat almost everyone else I looked at. So, I essentially ended up using them for two different stages of the financial lifecycle. But for pure corporate expense card management? Divvy was the smoother ride, hands down.