Picking the Right Tool for the Job

You know the drill. My company was growing, fast. Suddenly, managing expenses felt like wrestling an octopus—too many receipts, too many cards, too much chasing people around. We were using a mishmash of spreadsheets and personal cards, and frankly, it was a mess. The CFO was breathing down my neck, demanding a proper system. So, I took on the task: a full-blown deep dive into expense management platforms. The goal? Find something simple, effective, and that wouldn’t make our finance team want to quit.

My initial shortlist was long, but after filtering based on our scale (mid-size, US-focused but with some international contractors), it boiled down to two heavyweights everyone kept talking about: Airwallex and Ramp. I figured the best way to choose was to actually use them. Not just demos, but real-world testing with a small group of power users.

The Ramp Experience: Speed and Simplicity

I started with Ramp. Everyone raves about their simplicity, and honestly, they weren’t wrong. Getting set up was shockingly easy. I linked our main bank account, and within an hour, I was issuing virtual cards to my test team. That instant issuance feature? Lifesaver. My testers loved it immediately.

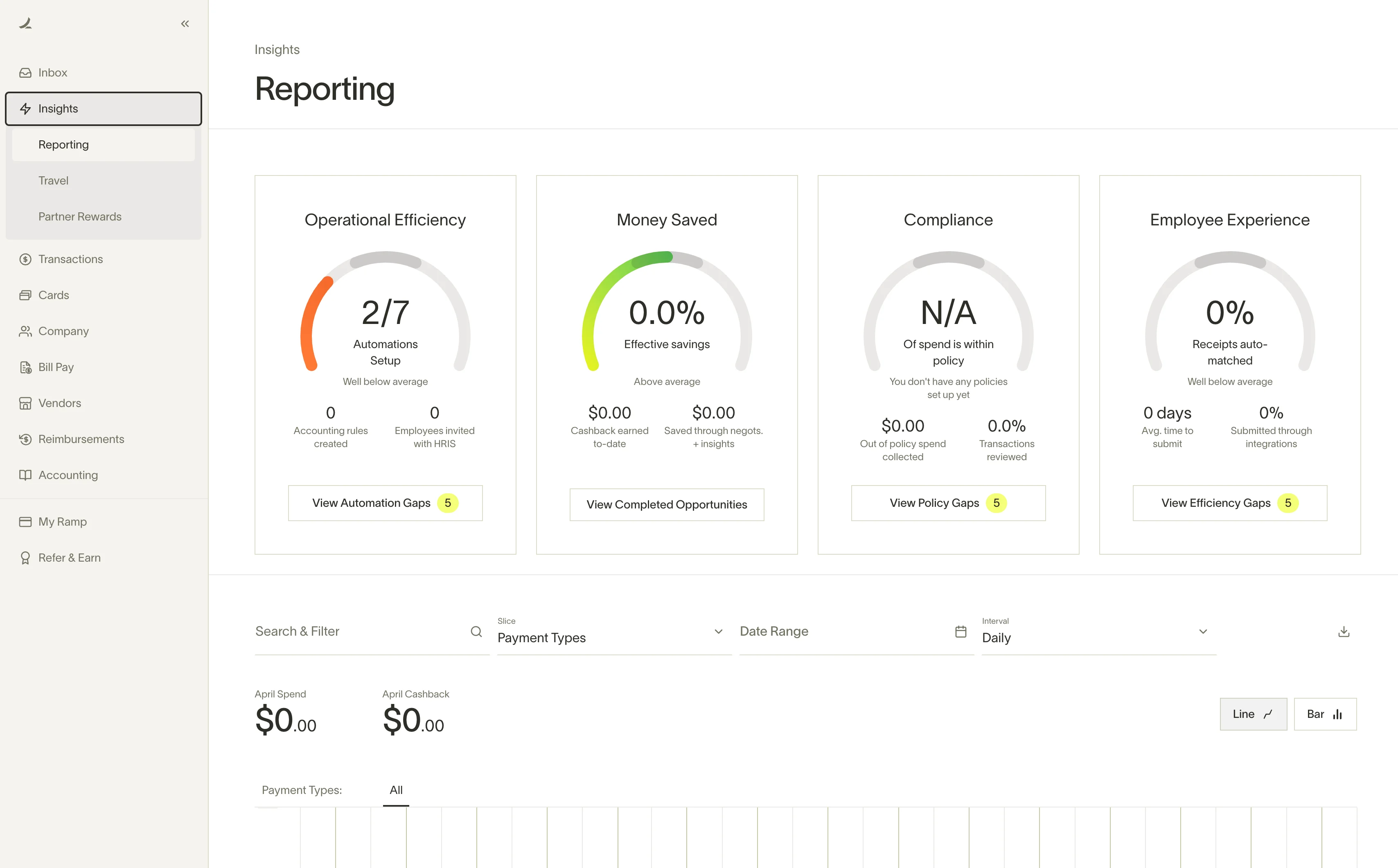

The core philosophy of Ramp seems to be about saving money. Their controls are brilliant. I set spending limits on every card—project-based, vendor-specific, whatever. It felt like I had a leash on every dollar leaving the company. The automated receipt matching was slick too. Someone buys lunch, snaps a photo, and boom, it’s categorized and reconciled. Minimal manual effort required from the employees, which means less whining and more compliance.

- Pros: Quick setup, excellent spend controls, seamless receipt capture, strong US cashback programs.

- Cons: Primarily focused on the US market. While they can handle international stuff, it felt like an afterthought. Exchange rates weren’t always the absolute best, and managing global contractors felt a bit clunky compared to their domestic offering.

The Airwallex Dive: Going Global

Next up was Airwallex. Now, this felt different right from the start. Ramp felt like a sharp US tool; Airwallex felt like a true global financial operating system. My immediate interest was their multi-currency wallets and international transfer capabilities. We had contractors in Europe and Asia, and sending them money via our old bank was a nightmare of fees and delayed transfers.

Setting up the Airwallex accounts was slightly more involved than Ramp—more KYC, more steps—but it made sense given the global nature. Once inside, the wallet system was fantastic. I funded EUR and GBP wallets directly, and then issued physical and virtual cards linked to those specific currency accounts. This instantly solved the FX headache. No more surprise fees on foreign transactions; the employee paid in EUR, and it came directly out of the EUR wallet.

For expense reporting, Airwallex was solid, but maybe a notch behind Ramp in terms of pure domestic simplicity. The receipt scanning was good, but the overall interface felt a little more “finance department” and less “marketing team who just wants to buy software.” However, the ability to collect payments in various currencies and hold them was a huge bonus we weren’t even initially looking for.

- Pros: Unbeatable multi-currency support, great FX rates, localized bank account details for seamless international payments/receipts, truly built for global operations.

- Cons: Setup was slightly heavier, the dedicated expense management workflow felt less central than Ramp’s; sometimes felt like overkill if you were purely domestic.

The Showdown Decision

After running both for two months, the choice became clear based on our primary pain point. If we were 100% US-based and only worried about controlling domestic spending and maximizing cashback, Ramp would have won hands down. It’s an efficiency monster for domestic tasks.

However, my biggest headache wasn’t controlling domestic lunch spending; it was the chaos of international payments and managing FX risk for our contractors. Airwallex solved this fundamentally. The fact that I could issue cards tied to foreign currency wallets and eliminate the surprise FX charges was the winning factor. We needed a global platform that also had excellent expense controls, not just an excellent domestic expense system that sort of handled global transactions.

We switched fully to Airwallex for all corporate expense management and global vendor payments. Ramp is fantastic, but for my specific requirement—taming the international money beast—Airwallex just fit the glove better. The implementation meant reorganizing some of our accounting flows, but the reduction in FX headaches and transfer fees was immediately worth the effort.