So, I was digging around, right? Just trying to figure out which banks are sneaky about hitting you with inactivity fees. You know, when you don’t touch your account for a while, and suddenly, bam, a fee pops up. It’s annoying, and frankly, feels like they’re punishing you for not being busy enough with your own money.

I started with my own bank, actually. Just checked their fine print—the stuff nobody ever reads. Turns out, they had a clause, but it was pretty soft. Like, you had to be completely dormant for maybe two or three years before they even thought about it. But that got me thinking: how bad are the others?

The Hunt Begins: Checking the Big Players

I decided to focus on the big national banks first. They’re the ones most people use, so they’re the biggest offenders, usually. I spent a whole afternoon just bouncing between different bank websites. I wasn’t looking for standard monthly maintenance fees; I was specifically hunting for the “dormancy” or “inactivity” fee rules. This required diving deep into their fee schedules, which are usually buried five clicks deep and written in lawyer-speak.

- Bank A: This one was tough to find. They didn’t call it an “inactivity fee.” They called it a “Safekeeping Charge” for accounts with no customer-initiated activity for 12 months. Sneaky! It wasn’t huge, maybe five bucks a month, but imagine that adding up.

- Bank B: Much clearer, thankfully. They straight up said if there’s no debit or credit activity for 24 months, they might start charging a quarterly fee. Better time frame, but still harsh if you just use it as a rainy-day fund.

- Bank C (A local one, surprisingly): They were the worst. Six months of no activity, and boom, a $10 monthly fee. I saw this and immediately thought, who even uses a local bank account that little? That’s aggressive.

The pattern I noticed was that it always hinged on “customer-initiated activity.” Simply receiving interest or a small direct deposit the bank set up doesn’t count. You have to actively move money, even if it’s just transferring a dollar in and out. That’s how they keep the clock from resetting.

Digging into Online Banks and Credit Unions

Then I shifted gears to the online-only banks and credit unions. I figured these guys, with their lower overhead, would be more forgiving. And mostly, they were.

I pulled up the fee schedules for about four big online banks. It was a refreshing change. Three of them had absolutely zero mention of inactivity fees. Their systems seemed built around the idea that if the money is there, it’s yours, whether you touch it or not. One of them had a clause, but it was tied to something ridiculous like five years of dormancy, and even then, they just said they might close the account and mail you a check, not charge you a penalty.

Credit unions were mostly the same—very relaxed. It seems like the bigger and older the institution, the more likely they are to slap you with these fees. It feels like an old-school punishment system that just never went away.

The Realization and the Quick Fix

After compiling all this info—which, trust me, took way longer than I expected because of the terrible website navigation—I realized two main things.

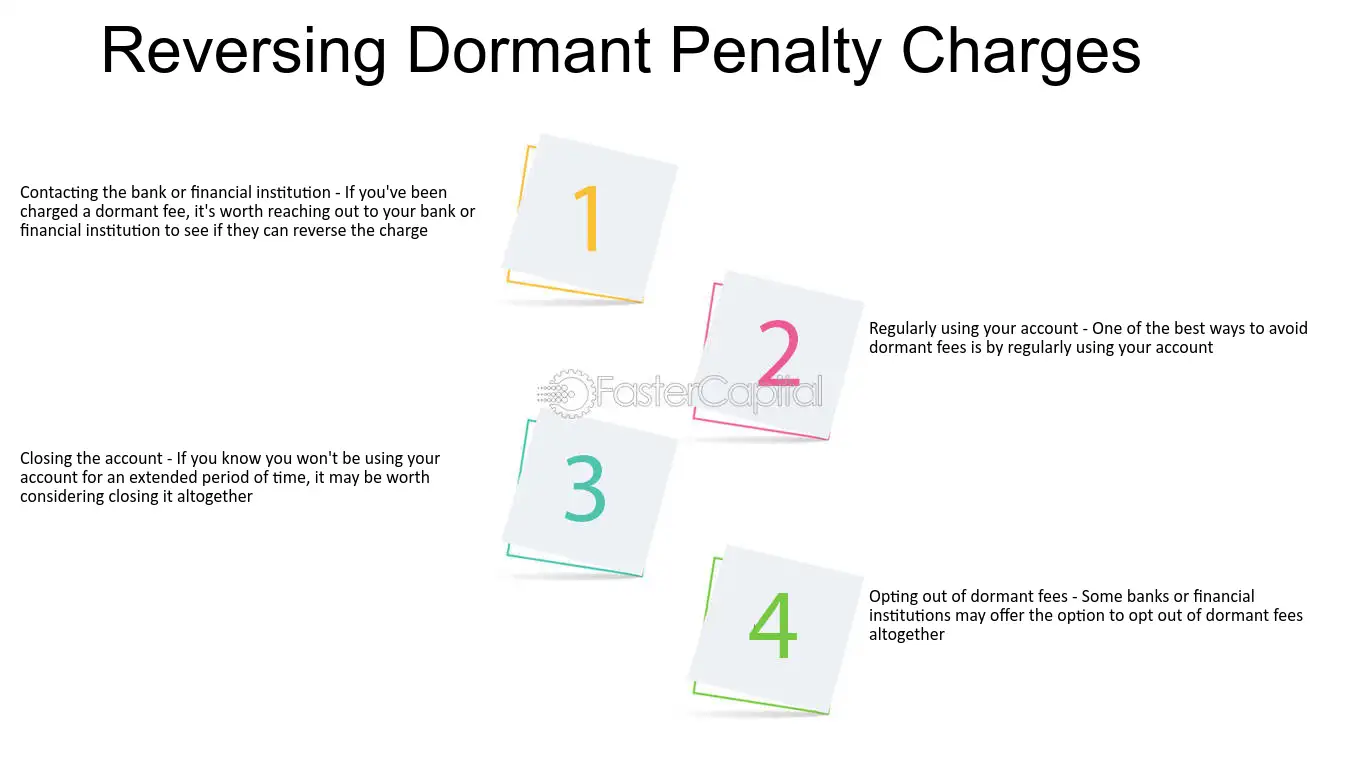

First, if you have an account that you only use maybe once a year, you need to check that bank’s specific timeline. Don’t assume. Second, the easiest fix to avoid this nonsense is to set up a small, recurring transaction. I mean minuscule. I’m talking about maybe transferring one single dollar from your checking to your savings every six months. That counts as customer-initiated activity and resets the clock.

I actually went ahead and tested this with one of my own older accounts I hadn’t touched. I set up a $1 internal transfer, waited a couple of weeks, and checked the status. The system definitely registered it as activity, keeping the dormancy wolves at bay. It’s a silly workaround, but it beats paying five bucks a month just because I forgot I had the account.

So yeah, if your bank is one of the big traditional ones, definitely go hunting in their fee schedule PDF. You might be surprised what penalties they’ve quietly set up just waiting for you to get busy enough to forget about them.