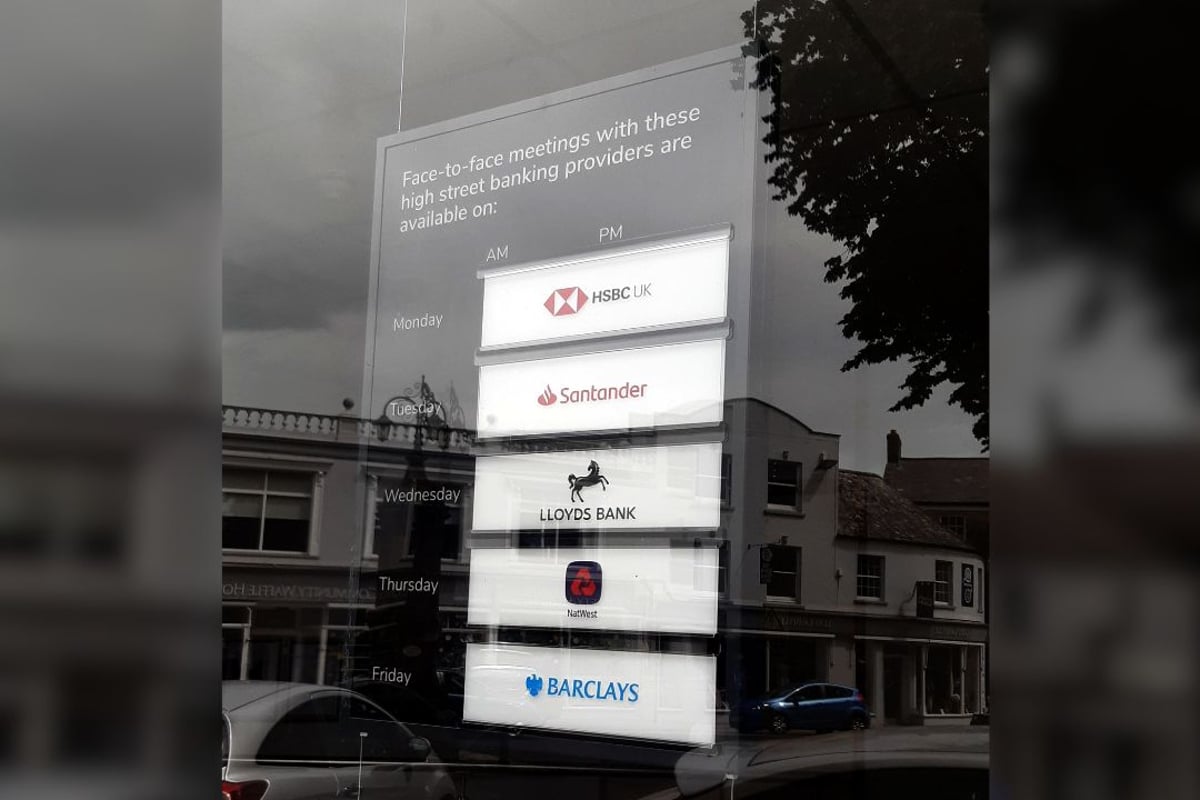

So, I’ve been running this little side gig, a small limited company here in the UK, for a couple of years now. Dealing with the high street banks for business stuff? Man, it’s a pain in the butt. Slow, terrible service, and let’s not even talk about the fees they sneak in.

I finally got fed up and decided it was time to move on. I kept hearing whispers about these newer, digital-first business accounts. You know, the ones that promise everything is faster and cheaper.

The Great Business Account Migration Begins

My first step was pure research. I just hammered the search engines: “best UK business accounts for limited companies,” “challenger banks for business,” all that jazz. I ended up with a shortlist of four main players: Revolut Business, Starling Bank, Tide, and Monzo Business. Yeah, I threw Monzo in there even though they started consumer-focused.

I started by eliminating Starling and Monzo pretty quickly. Starling’s offering felt a bit too basic for what I needed in terms of integrations, and Monzo’s business side was still really new and seemed to lack some essential features I rely on, like proper multi-user access down the line.

That left me with Revolut Business and Tide. This is where the real digging happened. I spent a good weekend just comparing their feature sets side-by-side, focusing hard on the things that actually slow me down.

- Invoicing: Do they make it easy?

- Integrations: Xero/QuickBooks link-up is non-negotiable.

- Fees: Hidden charges for transfers or international payments.

- Support: What’s the helpline situation? I hate chatbots.

Testing the Waters with Tide

I decided to jump in with Tide first. Why? Their setup process was stupidly simple. I literally had an account number and sort code in under twenty minutes after uploading my ID and company details. It was instant, zero fuss. That immediately blew the two weeks it took my old high street bank to approve my application out of the water.

Using Tide was decent. The app is clean, and tagging transactions for accounting is slick. The Xero integration worked exactly as advertised; transactions flowed through nicely every night. But here’s where I hit a snag: their customer support. It’s almost entirely in-app chat. When I had a slightly complex query about setting up a Direct Debit mandate, I felt like I was talking to an AI that just kept circling the same FAQ responses. It was frustrating.

The Pivot to Revolut Business

After about three months with Tide, I felt it was good, but not great. I needed more international flexibility and better premium features without paying an arm and a leg. So, I opened a Revolut Business account as well.

Setting up Revolut took slightly longer than Tide, maybe an hour or so for verification, but still miles ahead of the traditional banks. I signed up for their ‘Grow’ plan because I do a fair bit of international payments for software services, and the included allowance saved me cash immediately.

The difference was night and day. Revolut isn’t just a bank account; it felt like a finance management platform. Their expense cards are excellent; I could instantly issue virtual cards to myself for specific SaaS subscriptions, setting limits on them. The multi-currency accounts are flawless; I received a payment in USD and held it in a separate USD balance without automatic conversion, which my previous bank would have slapped a hefty fee on.

The Xero connection was robust, maybe even smoother than Tide’s. And, surprisingly, their support felt more capable, offering slightly more human interaction when I actually needed it, albeit still through chat.

Final Conclusion: Making the Switch Permanent

I officially dumped my old high street bank last month. It felt fantastic. I consolidated everything into the Revolut Business account. Tide was a solid contender, especially if you prioritize super simple UK invoicing, but Revolut’s global capabilities, integrated expense management, and ability to handle multiple currencies seamlessly tipped the scales for my specific needs.

If you’re running a small UK limited company and are tired of paying exorbitant fees for terrible service, seriously look at the digital options. They’re not just hype; they actually save time and money. The transition was easy; the ongoing management is easier. Highly recommend taking the plunge.