Man, I remember scratching my head over this a while back. It felt like everyone was pushing these newfangled virtual cards, but I was so used to just whipping out my physical piece of plastic. So, I went down a rabbit hole trying to figure out if I actually needed both, or if one was clearly better.

The Old Reliable: Physical Cards

I started with what I knew. Physical cards are just comfort, right? You get it in the mail, you activate it, and boom, you can use it everywhere. I mean, literally everywhere. Gas stations, ancient POS systems at tiny shops, even those dodgy vending machines. That tactile feel of knowing you have cash accessible is just… reassuring.

- I used my physical card for all the heavy lifting: big purchases, travel, and anything that needed a signature or a chip-and-PIN interaction where I couldn’t trust the connectivity.

- My main friction point? Losing it. Or, worse, having it skimmed at some sketchy ATM. I had one instance where I paid for parking at a remote lot, and bam, fraudulent charges started showing up the next day. A complete pain to cancel, wait for a new card, and update all those subscriptions. Took forever.

I realized the physical card’s strength is its ubiquity, but its huge weakness is security and replacement hassle. Once that number is out there, it’s out there.

Diving into the Digital Deep End: Virtual Cards

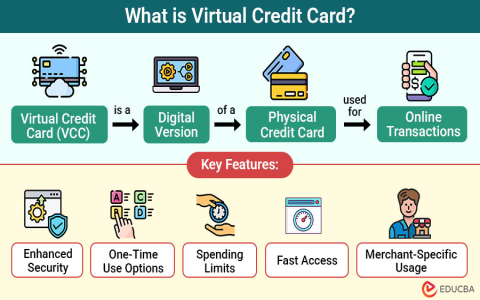

I had heard the hype about virtual cards, mostly from tech blogs, and decided to give my bank’s virtual offerings a shot. Setting it up was surprisingly straightforward. Basically, my bank let me generate new card numbers tied to my actual account, but they weren’t printed on any plastic.

The first thing I used it for was online shopping. And holy cow, what a difference. Every time I bought something from a place I hadn’t used before, or worse, a subscription service I knew I’d probably cancel in six months, I’d just generate a new card number. It felt like a disposable glove for my wallet.

Here’s the process I settled on:

- For Subscriptions: I created a dedicated virtual card with a low limit—say, $200. This way, if Hulu or whoever decided to suddenly jack up the price, they couldn’t drain my real account. If I cancel the service, I just kill the virtual card number instantly. No more rogue charges.

- For Sketchy Websites: Bought something from a niche seller on Instagram? Generated a single-use card number. Once the transaction cleared, I deleted it. If that merchant’s database ever got hacked, all the thieves would get is a useless, already-expired card number.

- For Free Trials: This was the best use. You know how those “free trials” require a card? I’d use a virtual card that I could instantly lock or delete after signing up. They could try to bill me three weeks later, but the card wouldn’t work. Pure genius.

The downside? You obviously can’t use a virtual card number if the machine only accepts physical insertion. Try paying for gas at an old pump with just a virtual card number written down. Good luck.

The Verdict I Landed On

After a few months of juggling both, I realized it’s not an “either/or” situation. It’s a “when and where” situation. I moved all my high-risk activities—online shopping, subscriptions, and new vendor payments—over to virtual cards. This instantly wall-off my main bank account number from 90% of the internet’s potential risks.

I reserved my physical card for places where I absolutely needed the plastic: ATMs, small local stores, restaurants that still take your card back to the counter, and travel where connectivity is questionable. Basically, if I have to physically hand over a card, it’s the physical one.

This hybrid approach completely cut down on my anxiety about fraud. I haven’t had to cancel my main card in over a year now, which used to happen semi-annually. Virtual cards handle the risk, and the physical one handles the legacy payments. You really need both, but you need to be smart about assigning roles to each one.