Alright folks, let’s talk about something I’ve seen way too many small business owners do, and trust me, it’s a time bomb waiting to go off: mixing personal and business accounts. Specifically, using your personal bank account for all your business income and expenses. I get it, when you’re starting out, setting up a whole new business structure, opening separate bank accounts—it all feels like a lot of hassle. But let me tell you why I stopped doing it, and why you absolutely should too, especially when the IRS comes knocking.

The Mess I Made Initially

When I first started my consulting gig years ago, I was super casual. Money came in, money went out. All through my regular checking account. I figured, hey, all the receipts are saved, right? When tax time rolled around, oh boy, what a nightmare. I was spending days and I mean days, scrolling through months of bank statements. Trying to figure out if that $50 charge was for a new monitor cable (business) or takeout pizza (personal). My spreadsheet looked like a toddler had a fight with a calculator. It was stressful, error-prone, and frankly, completely unsustainable.

I distinctly remember one year, I thought I had everything sorted. I sent my neatly color-coded spreadsheet to my accountant, all proud of myself. He took one look and basically said, “This is garbage.” Not in those exact words, but close enough. He spent hours trying to untangle my transactions, and it cost me extra in accounting fees. That was the first big lightbulb moment.

The IRS and the Co-Mingling Issue

Now, let’s fast forward to the real kicker: the potential IRS audit. This is where using personal accounts for business transactions goes from being merely inconvenient to genuinely risky. I heard a terrifying story from a friend of a friend who got audited. Their business was structured as a sole proprietorship, and they thought the personal account thing was fine.

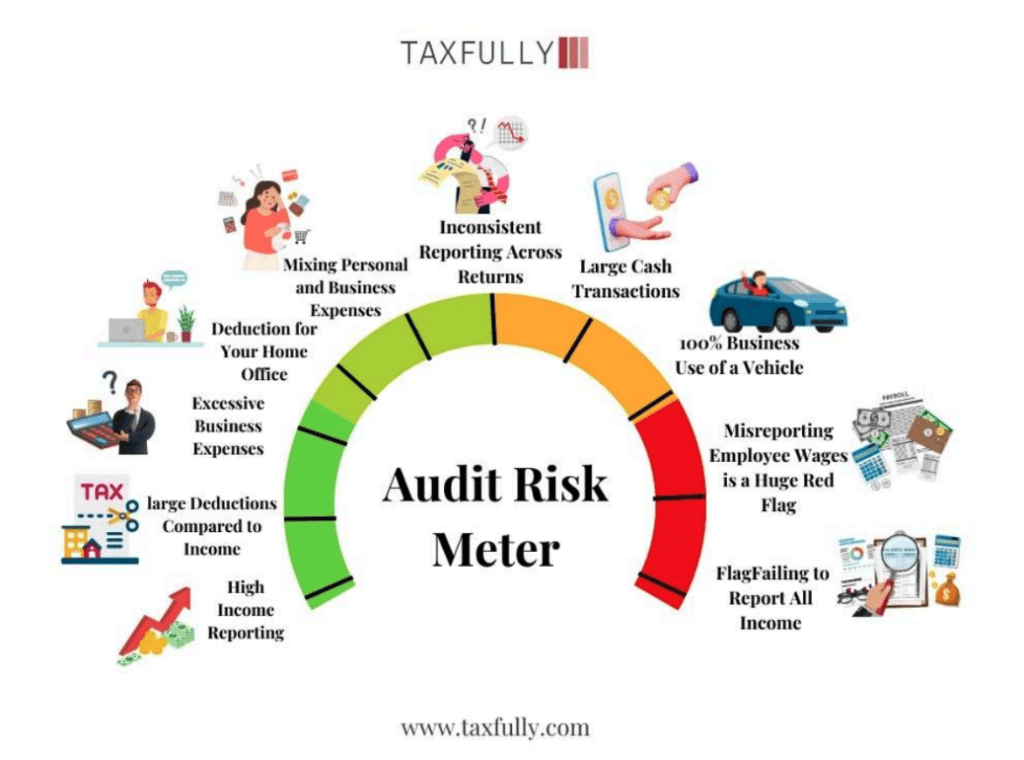

When the auditor started digging, they immediately flagged the commingling of funds. See, when you mix everything, you lose the crucial separation between you, the person, and your business entity. The IRS sees your personal account, full of payments for utilities, groceries, maybe even a weekend trip, mixed in with client payments and supplier invoices.

What happens then? Suddenly, every single personal expense becomes suspect. The auditor doesn’t just look at the line items you marked “business expense.” They start questioning EVERYTHING. They might disallow deductions because they can’t clearly establish the “ordinary and necessary” business purpose without excessive documentation for every single transaction.

This is the terrifying part: The perceived lack of separation can actually challenge the legitimacy of your business expenses overall. The auditor looks at the haphazard record-keeping and thinks, “If they can’t keep their money straight, how can I trust these deductions?”

What I Did to Fix It Fast

I realized I needed to stop playing games. I marched down to the bank and opened a dedicated business checking account and a business savings account. Even as a simple sole proprietor initially, this was mandatory. Then, I set up a system:

- All income goes into the business checking account. No exceptions.

- All business expenses (software subscriptions, equipment, contractors) are paid directly from the business checking account using a dedicated business debit card or checks.

- If I need to pay myself, I do a simple transfer from the business checking to my personal checking—a clear owner’s draw, properly documented.

It sounds simple, right? But the immediate benefit was clarity. When I pull up my bank statement now, it is 100% business activity. Tax time went from a week-long headache to a few hours of verification. And critically, if the IRS ever calls, I hand them the business statements, and my personal financial life stays separate and private.

Look, if you’re still using that old checking account for your side hustle or even your main gig, stop. Open the business account today. The small amount of effort now is insurance against massive headaches, disallowed deductions, and the terrifying prospect of a deep dive into your personal life by Uncle Sam later.