So, I’ve been running my little side hustle for a while now, and honestly, managing the money part was getting to be a real pain. I mean, the bank fees alone were eating into my margins like crazy. Especially when dealing with international payments, which is pretty much my bread and butter these days.

I started with my regular high street bank, you know the one. Every transfer was a small headache and a hefty fee. Like, seriously, what is up with those exchange rates? They’d always sneak in a little extra cut. I tracked it for three months, and those sneaky fees added up to something substantial—enough to buy me a decent new monitor.

The Great Comparison Hunt Begins

I decided I had to do better. I started digging around, looking at all the fintech options. I needed something that was cheap, reliable, and didn’t make me jump through hoops for foreign currency transactions. I pulled up spreadsheets, which I am absolutely terrible at, but I forced myself. I was determined to save every penny I could.

- Revolut Business: Looked promising at first. Setting up was a breeze. But then I hit the monthly fee structure if you wanted anything beyond the absolute basic tier. And the limits on fee-free transfers? Too low for my current volume. I felt like I was constantly checking their limits.

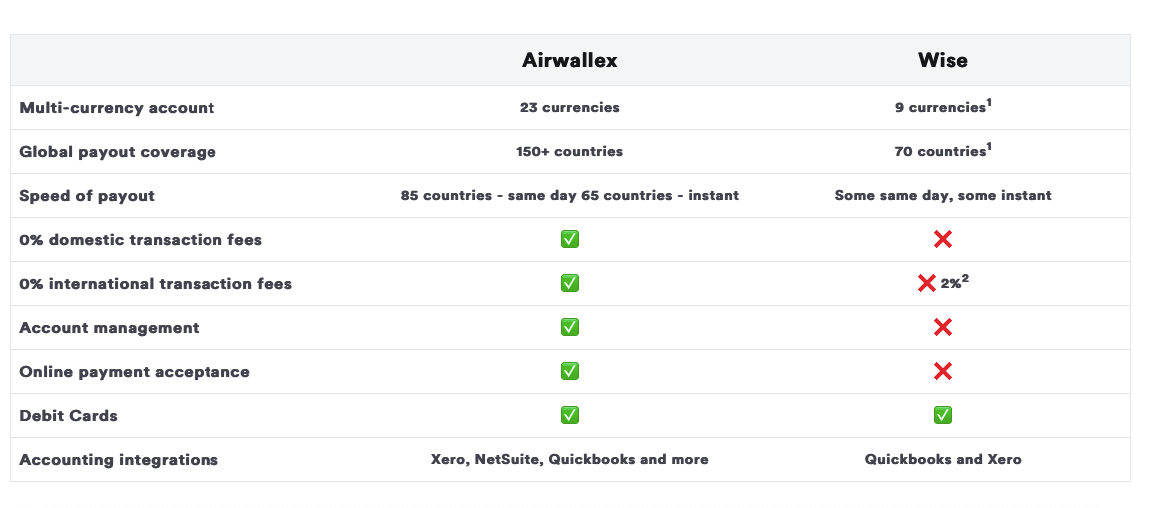

- Wise Business: Used them personally for ages, great for small transfers. But for consistent business use, particularly with multiple currency accounts, the fees for holding certain currencies and withdrawing started to sting a bit when the volume increased. They are transparent, sure, but transparency doesn’t always mean free.

- Local Banks (Again): Went back and checked with a few local competitors, hoping for some hidden small business gem. Nope. They all want either a high monthly fee, or they demand a minimum balance that would just sit there gathering dust. That’s essentially dead money.

Stumbling Upon Airwallex

Then someone on a forum I frequent mentioned Airwallex. I was skeptical. Another platform, another set of hidden charges, I thought. But the key thing they kept emphasizing was: no monthly account fees. That was a big selling point immediately.

I opened an account just to test the waters. The verification process was straightforward, a bit slow on the initial business check, but nothing painful. Once I was in, I started moving small test amounts.

What I immediately loved was how simple the fee structure was, or rather, the lack thereof for the basics. Setting up local currency accounts? Free. Receiving money? Free (mostly, unless the sender’s bank hits you, but that’s not Airwallex’s fault). The real killer feature for me was the exchange rate—it felt genuinely close to the mid-market rate, way better than the 3-4% margin my old bank was taking.

I tracked my first 10 large international transfers. With my old bank, those would have cost me around $300 in total fees and lousy exchange rate difference. With Airwallex, the total cost for the equivalent transfers was less than $50. That’s a massive saving right there, purely from tighter exchange spreads and zero monthly fees.

The Practical Payoff

My entire process is smoother now. I’ve linked Airwallex to my invoicing software, and receiving payments from clients in Euros, USD, and AUD is seamless. I don’t have to worry about my bank charging me $15 every time a payment lands in my account.

I realize that for ultra-high volume users, maybe other services offer benefits, but for someone like me—a small business doing consistent, moderately sized international transactions—the “Free” part of Airwallex, especially the lack of a monthly commitment, is the absolute winner. It took a lot of spreadsheets and wasted time chasing down fees, but finally landing on a service that just lets me transact without constantly nickel-and-diming me has been a huge relief. The rest of the providers I looked at all had some sort of recurring drain; this one doesn’t, and that’s why I stuck with it.