So, let’s talk about that time I was pulling my hair out trying to find a payment that just vanished into thin air. The title says it all: The Transfer That Never Arrived. It was a headache, seriously.

I was expecting a pretty important chunk of cash from an international client. They sent the money, they showed me the receipts, the whole nine yards. Said it left their bank, no problem. I waited. And waited. A week went by, nothing. Two weeks, zip.

Initial Panic and Digging for Clues

My first step, obviously, was calling my bank. Felt like talking to a brick wall. They kept telling me, “It’s not here, check with the sender.” Classic runaround, right? The client was getting frustrated too because their bank said it went out fine, tracking number and everything. It was a proper Swift transfer, supposedly the gold standard for global money moves.

I knew I couldn’t just trust the standard customer service line. Those folks only look at what hit the local ledger. I needed to see what happened in the deep network. So, I started demanding specific things. Not just ‘where is the money,’ but ‘show me the MT103 confirmation.’ That’s the nitty-gritty message banks send each other when a payment is actually made.

- I pushed the client to get their bank to reissue the MT103 copy.

- I cross-referenced the beneficiary details. Account number, name, BIC/SWIFT code. Everything matched up.

- I looked up the common correspondence banks that typically handle transfers between their country and mine.

The MT103 confirmed the transfer left the originating bank and was sent to an intermediary bank (let’s call it Bank X) because direct transfers weren’t possible between the two countries’ main banking systems.

The Black Hole: Tracking Bank X

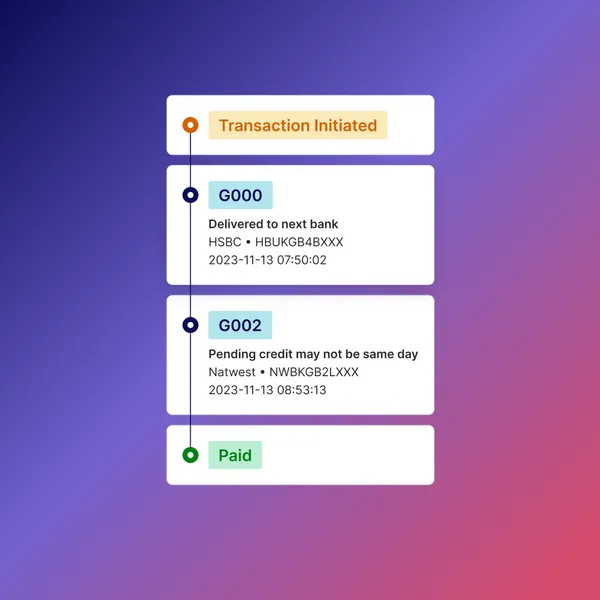

This is where the fun began. Bank X was supposed to forward the money to my bank. But my bank had no record of receiving any corresponding message (like an MT202 or similar intermediary notification) from Bank X.

I started reading up on how Swift codes and transfers actually work, diving deep into forums and technical banking explainers—stuff a normal person shouldn’t have to read just to get paid. I learned that sometimes, especially if currency conversion is involved or if the transfer hops multiple correspondent banks, a message can get stuck or incorrectly routed.

I went back to the client and their bank. I told them, “Look, the money is stuck at Bank X. We need an inquiry message (an MT199 or MT299) sent from your bank to Bank X, specifically asking for the status of the MT103 reference number.”

This was the real key. Most customer service agents won’t initiate this unless you ask for it by name. It forces the sending bank’s back office to actively trace the message through the actual Swift network.

The Breakthrough

After about a week of internal arguing between the client and their bank’s operations team, they finally sent the inquiry. And then, bam, we got a reply. Turns out, Bank X had received the funds but flagged the transfer internally. Why? A single missing character in the routing instructions for the final beneficiary bank (my bank) in their internal system. Something stupidly simple, probably a typo made by a human somewhere along the line.

The money wasn’t lost; it was just sitting in an internal suspense account at Bank X, waiting for manual review because the automated system couldn’t match the final destination BIC code perfectly.

Once the error was identified through the formal Swift inquiry process, Bank X manually corrected the routing details and resent the transfer instruction. Within 48 hours, the money finally hit my account. It took almost a month from the initial sending date.

The biggest takeaway? Never trust the first answer. If a Swift transfer vanishes, you need to demand the MT103 confirmation and then trace which correspondent bank has received it, pushing for formal inquiry messages to force the network banks to look past their automated systems. It’s a lot of work, but sometimes it’s the only way to move the money.