So, I’ve been juggling client payments and trying to keep my business finances straight for a while now. You know how it is—freelancing means you’re your own accounting department, and frankly, I suck at accounting. I needed a better bank, something built for folks like me who deal with international clients and need simple tools without the ridiculous fees big banks charge.

The Hunt Began: Airwallex and Novo on the Radar

I started with the usual suspects, but quickly narrowed it down to two contenders that kept popping up in freelancer forums: Airwallex and Novo. Both promised easy setup and low fees, but they seemed to target slightly different needs, which made the comparison tricky.

My biggest pain point was cross-border payments. I get paid in Euros, sometimes USD, and converting it back to GBP or EUR (depending on where I am that month) always ate a huge chunk of my income. I was looking for a platform that could handle multi-currency wallets efficiently.

First Dive: Novo’s Simplicity

I tried Novo first. Setup was a breeze, seriously. It’s tailor-made for US freelancers and small businesses. They pitch themselves as absolutely free—no monthly fees, no minimum balances. That sounded great. I opened an account in about 15 minutes, linked it to my PayPal and Stripe, and started running some small domestic transactions through it.

- Pros: Super clean interface, great integration with invoicing tools like QuickBooks, and simple reserve accounts for setting aside tax money. It was pure simplicity.

- Cons: The major drawback for me, being a global freelancer, was the currency conversion. While they boasted no foreign transaction fees on their end, the actual exchange rates they offered were middle-of-the-road. And managing multiple currency wallets? Forget it. It’s fundamentally a USD account. I realized quickly this wouldn’t solve my main cross-border issue.

Novo is fantastic if you are 100% US-based and just need a smart, free business checking account. But for my European clients and non-USD earnings, I was still losing money on every transfer.

Switching Gears: Embracing Airwallex’s Global Reach

After a few months of using Novo primarily for domestic transactions and still using another service for international stuff, I decided to fully commit to testing Airwallex.

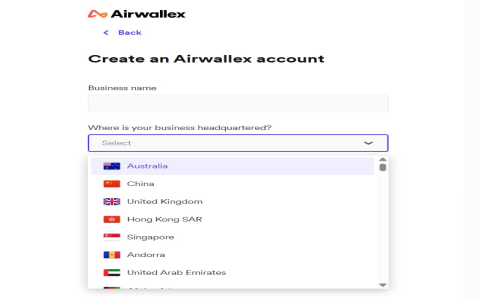

Airwallex felt like a step up in complexity, but only because it offers so much more. They are built for cross-border transactions from the ground up. I needed to provide a bit more documentation during setup, but once approved, BAM! I had virtual accounts in AUD, USD, EUR, GBP, and HKD, instantly. This was the game changer.

The ability to give my European clients an actual EUR bank account number meant they paid me locally, avoiding expensive wire fees on their end and massive conversion fees on mine. I could hold the Euros until the exchange rate was favorable, or just spend directly using their borderless Visa card.

I started moving my main income streams over. When a USD payment hit my Airwallex USD account, I could instantly convert a portion to EUR at interbank rates (or damn close to them) with a tiny, transparent fee. It was dramatically cheaper than what Novo or traditional banks were offering.

The Final Verdict After Six Months of Testing

I used both platforms concurrently for half a year to truly compare. It wasn’t about which one was ‘better’ overall, but which one fit my specific freelance business needs.

Novo: Excellent for US-centric operations, simple budgeting, and free domestic banking. If my freelancing stayed strictly within the US borders, this would be my winner hands down due to its brilliant app and zero fees.

Airwallex: The undisputed champion for the global freelancer. Managing and transferring money across multiple currencies without getting fleeced is their specialty. Getting paid in local currencies saved me hundreds of dollars over that testing period.

In the end, I consolidated my primary business banking with Airwallex. It directly solved the most significant financial hurdle I faced: maximizing my international revenue. Novo is still a great product, but Airwallex’s focus on borderless money management simply aligned better with my actual day-to-day operations as a global digital nomad.