So, I’ve been messing around with how to make my spare cash actually do something, you know? Not just sit there gathering dust. Everyone talks about Treasury Bills—T-Bills—because they’re supposed to be super safe, backed by the government and all that jazz. But then I stumbled across Airwallex Yield, and honestly, I had to see which one was the real winner for putting money away and seeing some decent return.

The Setup: Getting My Hands Dirty

First thing, I needed some money to play with. Nothing huge, just a decent chunk I could afford to lock up for a little while. I decided to spread it around. I opened an Airwallex account—which was surprisingly easy. They make it feel like you’re setting up a regular bank account, but for your business funds or just savings. Then, I allocated a portion to their Yield product. I wanted to see the magic happen pretty much immediately.

- Airwallex Yield Onboarding: Pretty slick. Went through the KYC stuff, deposited the funds, and then clicked the ‘Yield’ option. It shows you the expected percentage right there. No complicated forms.

- T-Bills Purchasing: This was a bit more of a hassle. Had to go through a brokerage account. I picked a short-term bill—like 4 or 8 weeks—to keep the comparison fair to the more flexible Airwallex option. The bidding process felt like something out of a finance textbook, not a straightforward saving tool.

The Numbers Game: What I Actually Saw

I tracked both for a couple of months. Not a super long time, but enough to get the feel of the returns and the accessibility. Keep in mind, I wasn’t looking for get-rich-quick schemes, just stability plus better-than-a-regular-savings-account interest.

Treasury Bills: The return was predictable. It’s fixed, and you know what you’re getting when you buy it. The main thing is that money is truly locked until maturity. If I needed those funds for an unexpected bill, I’d have to sell the T-Bill on the secondary market, which involves a whole other level of complexity and risk of losing a bit of principal if rates shifted.

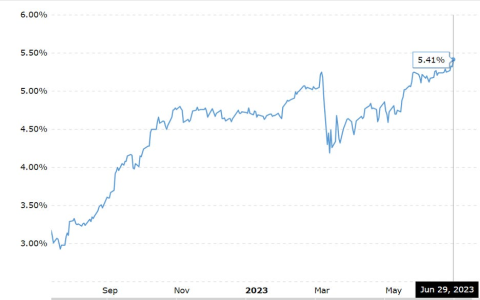

Airwallex Yield: This is where things got interesting. The yield rate floats a bit, tied to high-quality money market funds, which is how they explain it. The crucial difference? Liquidity. I could literally pull the money out almost anytime. It accrues daily, and the interest showed up regularly. I didn’t feel like my money was stuck behind a concrete wall.

My Real-World Experience Breakdown

I run a small side hustle, so sometimes I need quick access to funds. This is where Airwallex absolutely crushed T-Bills for me.

T-Bills Strengths:

- Pure safety. Government guarantee is nice for peace of mind.

- Tax benefits (state and local tax exemption on interest).

T-Bills Weaknesses (for me):

- Zero flexibility. Money is locked tight until maturity.

- The buying process is clunky if you’re not a finance expert.

- Reinvesting is another manual step.

Airwallex Yield Strengths:

- Instant access. If I needed the money tomorrow, I could pull it.

- Competitive returns that often hovered just above what T-Bills were offering when accounting for the friction.

- Super easy interface. Managing and moving the money was simple via their dashboard.

Airwallex Yield Weaknesses:

- Not explicitly government-backed, though they invest in highly-rated government securities (money market funds). It feels safe, but it’s not the same as a T-Bill guarantee.

- The rate fluctuates, so you aren’t 100% sure what the exact return will be next month.

The Final Call on Savings

For my personal situation—needing good returns but also needing flexibility—Airwallex Yield won hands down. The slight loss in absolute, explicit government safety was easily offset by the ability to access funds whenever. For emergency savings or operating cash that needs to work for you without being tied up for months, it was the much better tool. T-Bills are for when I want to tuck money away and literally not touch it for a year, but for my active savings, I’m sticking with the flexibility that Airwallex offers. It felt less like a complex investment and more like a smarter savings account.