The “Instant” Problem That Wasn’t Instant At All

Okay, so I’ve been messing around with this new side project, right? It involves setting up micro-transactions, really small stuff, and I needed the funds to clear super fast. Like, seriously fast. I signed up for this payment processor that promised “instant” payouts. Big promises, you know?

I started this whole thing assuming “instant” meant what it said. I was picturing seconds, maybe a minute or two, tops, like when you transfer money between accounts at the same bank. So, I built the entire system around this instant clearance.

The Setup and First Test

My first step was integrating their API. That part was actually pretty smooth. Their documentation wasn’t too bad, which is always a pleasant surprise. I spent a couple of evenings linking up the payment gateway, handling the webhooks, and making sure the data flows back into my little database correctly. Everything looked green on the development side.

Then came the first real test. I simulated a small transaction, just a measly $5. The platform immediately confirmed the payment was successful. Great! I went into my dashboard on their site, and sure enough, $5 was sitting there, marked as “Available for Payout.”

I hit the “Withdraw” button, excited to see that money appear in my business bank account instantly. I mean, they promised instant funding, right?

Waiting, Watching, and Pushing Buttons

I waited five minutes. Nothing. Ten minutes. Still nothing. I checked the transaction status. It had moved to “Processing.” That’s the first red flag. “Instant” doesn’t usually involve a “Processing” stage that lasts longer than a glance.

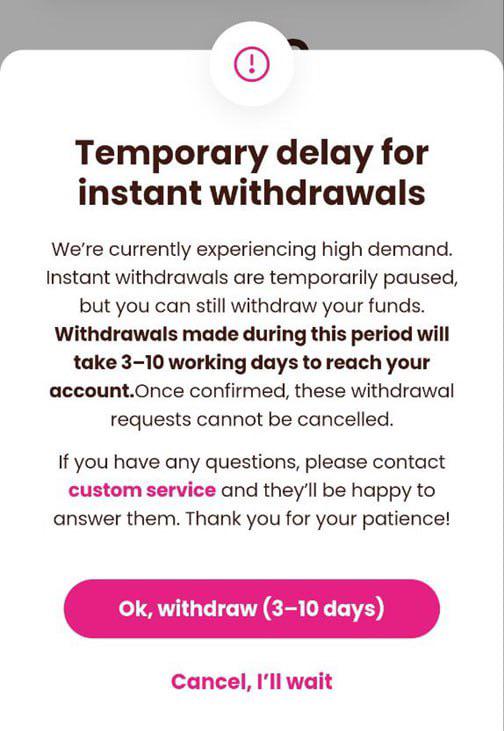

I went back to their FAQ. Dug deep into the fine print. And that’s where the fun started. Turns out, “instant” meant instant initiation of the payout, but the actual transfer time depended on the receiving bank’s processing speed, which they casually mentioned could take up to three business days.

Three business days! That’s not instant. That’s just standard ACH transfer time packaged with a glossy marketing term.

I spent the whole first day constantly refreshing my bank statement. Nope. Just crickets. I even tried withdrawing a smaller amount again late that evening, thinking maybe the first one just got stuck in some batch job.

The Ticking Clock and the Realization

The second day rolled around. Still waiting for the first withdrawal. I called their customer service, which took forever to get through. The rep gave me the standard line: “We processed it instantly on our end, sir. It’s now up to your bank.” Very helpful.

It was clear I couldn’t rely on this being instant for my users. My entire project flow needed to be re-engineered. I had structured the backend logic to immediately release the service as soon as the funds were “instantaneously” ready for payout. Now, I had this massive gap where the money was nowhere but on the processor’s ledger.

I had to pivot the entire process. I spent the afternoon re-writing the transaction logic to confirm payment before initiating the service, acknowledging that the actual funding to me would be delayed. It was basically decoupling the service delivery from the actual receipt of the funds.

Three Days Later: The Funds Arrive

On the morning of the third day, both the first and second test deposits finally hit my bank account. Exactly 70 hours after I initiated the first one. So much for instant.

The takeaway? Never trust the marketing term “instant” when dealing with financial transactions involving different banks. Always test the full cycle and read the fine print about actual settlement times. I wasted nearly three days of development assuming a marketing claim was technically accurate. Now, the system works great, but the whole “instant” dream is totally gone. It’s a 3-day process, and everyone involved—me and the users—has to just live with that delay.