Man, let me tell you about a dropshipping headache I finally figured out, the dreaded Double Currency Conversion. It was absolutely killing my profit margins for months, and I just kept wondering why my numbers weren’t adding up like they should.

I started this thing pretty small, sourcing products mainly from China—AliExpress, you know the drill. My store was set up on Shopify, selling to the US market, so everything was in USD. Simple enough, right?

Wrong.

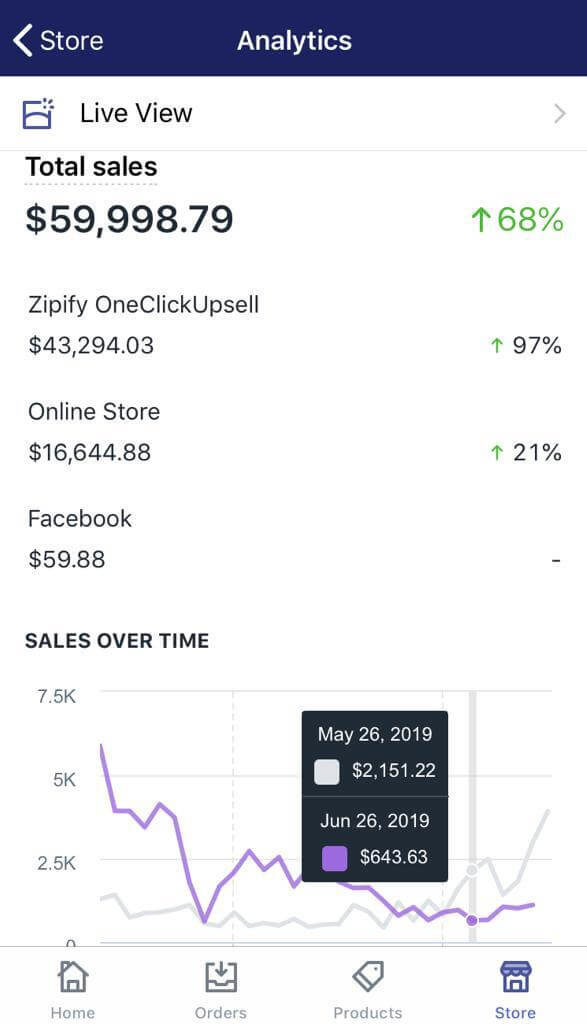

I noticed early on that my bank account balance wasn’t reflecting the profit I calculated. I’d sell something for $30, the product cost me maybe $10, and shipping was $5. Should be $15 profit before ads and Shopify fees, but after a week, when the funds settled, the actual take-home felt like $12 or sometimes even less. It was baffling.

The Setup That Blew Up My Margins

My initial setup was pretty standard. I was using:

- Shopify store (USD pricing).

- A payment gateway like Stripe or PayPal (receiving USD).

- Sourcing from AliExpress (prices usually in USD, but the supplier is outside the US).

- My personal business bank account (in my local currency—let’s say CAD, for example).

I thought everything was fine because the customer paid in USD, and Stripe/PayPal processed USD. But here’s where the snake ate its own tail.

Step One: The Customer Pays. They see $30 USD and pay $30 USD. The money lands in Stripe or PayPal as USD. So far, so good.

Step Two: Payout to My Bank. Since my actual bank account for the business was in CAD, Stripe or PayPal would convert the USD revenue into CAD before dumping it into my account. This is Conversion 1. They use their conversion rate, which is usually worse than the interbank rate, and slap on a hidden fee. Lost money there.

The Real Problem: Paying Suppliers

The money coming in was bad enough, but paying the suppliers was the real killer. I had to buy the product, which cost $10 USD.

Step Three: Paying the Supplier. I was using my business debit card, linked to that same CAD bank account, to buy the product on AliExpress. AliExpress charged $10 USD.

But wait, my bank account is in CAD. So, the bank first took the $10 USD charge, converted it from USD to CAD at their lousy rate (worse than Stripe’s rate!), and charged me in CAD. This is Conversion 2, and often, the bank added another foreign transaction fee on top of the bad rate.

So, I was losing money on the revenue coming in (USD to CAD) and losing money again on the expense going out (USD needing to be converted from my CAD account). It was essentially paying two conversion fees on every single sale!

The Fix: Switching to a Multi-Currency Bank

I finally got fed up and did some serious digging. The solution was surprisingly simple, but it required a setup change. I needed to keep the money in USD for as long as possible.

I switched my primary business banking to a platform that offered multi-currency accounts, something like Wise or a specialized business bank that allows you to hold foreign currency balances.

Here’s the new flow:

- Customer pays $30 USD.

- Stripe/PayPal pays out the $30 USD directly into my new USD account balance. No conversion fee.

- When I pay the supplier $10 USD on AliExpress, I use the debit card linked to that same USD balance. No conversion fee.

I let the USD stack up. I only converted the money to CAD when I absolutely needed to pay myself or local bills, and when I did convert, I used the platform’s better exchange rate tool, not my old retail bank’s terrible rate.

The moment I implemented this, my profit margin jumped noticeably. It wasn’t just a few cents; depending on the conversion rates that month, it was easily 3-5% back onto my bottom line, just by eliminating those two completely unnecessary currency conversions on every single order. If you’re dropshipping internationally and your receiving bank isn’t the same currency as your transactions, fix that immediately, trust me.