Okay, so I finally got around to testing out that QuickBooks integration stuff. You know, trying to get my little business’s money tracking to stop being such a manual pain in the butt. I wanted everything to just flow, automatically, no more copying numbers from one screen to another. That was the dream.

The Starting Line: What I Had

I’ve been using a few different tools. I use one specific platform for invoicing and collecting payments—it handles the customer side of things really well. But then I have my trusty old QuickBooks Desktop setup for the actual bookkeeping, because, well, I’m old school and I like having that level of control. The headache was always the bridge between them. Every week, I’d sit down, pull up the payment platform reports, and manually key in the totals into QB, categorizing everything. It took forever and, honestly, I often made silly little mistakes.

The Integration Hunt and Setup

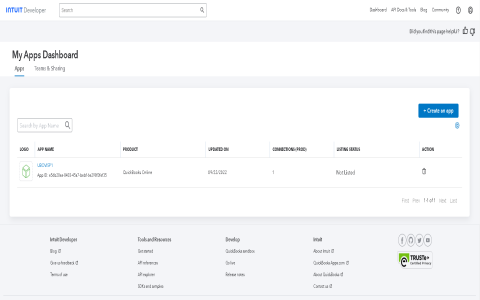

I started by looking at the integration options offered by my payment platform. They advertised a direct QuickBooks sync, but it was specifically for the online version. Ugh. That meant I had to figure out a workaround for my Desktop version. I ended up needing a third-party connector app. Found one after a bit of digging—a relatively inexpensive subscription service that promised to be the missing link.

Installation was surprisingly clunky. It wasn’t just a simple download and click install. I had to make sure my QuickBooks file was properly set up to allow external access—lots of permission settings and authentication tokens. Took about an hour just to get the two systems to even shake hands without throwing an error message. I felt like I was debugging ancient software.

- Downloaded the connector application.

- Set up QB user permissions for external access.

- Linked the two systems using API keys and tokens.

- Ran the initial sync test—it failed the first three times because of date formatting issues.

The Test Run: Automating the Data Flow

Once everything was connected, the moment of truth came. The idea was simple: when an invoice was marked as paid in my payment platform, that transaction should instantly appear correctly logged in QuickBooks, hitting the right income accounts, and recording the associated fees.

I ran a few simple, clean transactions first. A $100 payment, no fees. It synced perfectly. Showed up right where it should. I was stoked.

Then I tried something more complex. A $500 payment with a 3% processing fee. This is where things got interesting. The integration recorded the $500 income, but it didn’t automatically handle the fee deduction and stick it into my expense account labeled “Processing Fees.” It just recorded the gross amount. I had to go back into QuickBooks and manually journal the fee out of the income account and into the expense account. Not exactly “automated bookkeeping,” was it?

I fiddled with the connector app settings. Turns out, there were highly specific rules I had to set up—mapping the fee lines from the payment platform to specific ledger accounts in QB. It wasn’t intuitive at all. It took me a full afternoon of trial and error, running dummy transactions until I finally cracked the code on the fee mapping.

The Final Review and Takeaway

After all that tweaking, I finally achieved about 95% automation. Now, when a payment comes through, the gross income is recorded, and the processing fee is immediately recorded as an expense, all within minutes. The remaining 5% manual work involves occasionally checking for transactions that might have unusual tax treatments or refunds, which the connector doesn’t handle gracefully.

My biggest takeaway? These integrations are never plug-and-play, especially when dealing with Desktop software. You really have to roll up your sleeves and understand exactly how each number is being moved and mapped between systems. If you’re willing to put in that initial grunt work to set up the mapping rules, it absolutely saves hours every month. I went from spending a few hours a week on basic data entry to maybe 30 minutes just double-checking everything. Worth the setup pain, but be warned: it’s not magic, it’s configuration.