Man, I gotta share this recent close call I had. You know, these scam artists are getting smarter, targeting freelancers like me who are always looking for that next decent gig. This one was a classic “overpayment” scheme, and it almost got me. I’m writing this down so maybe someone else can spot it before they get burned.

The Gig That Started It All

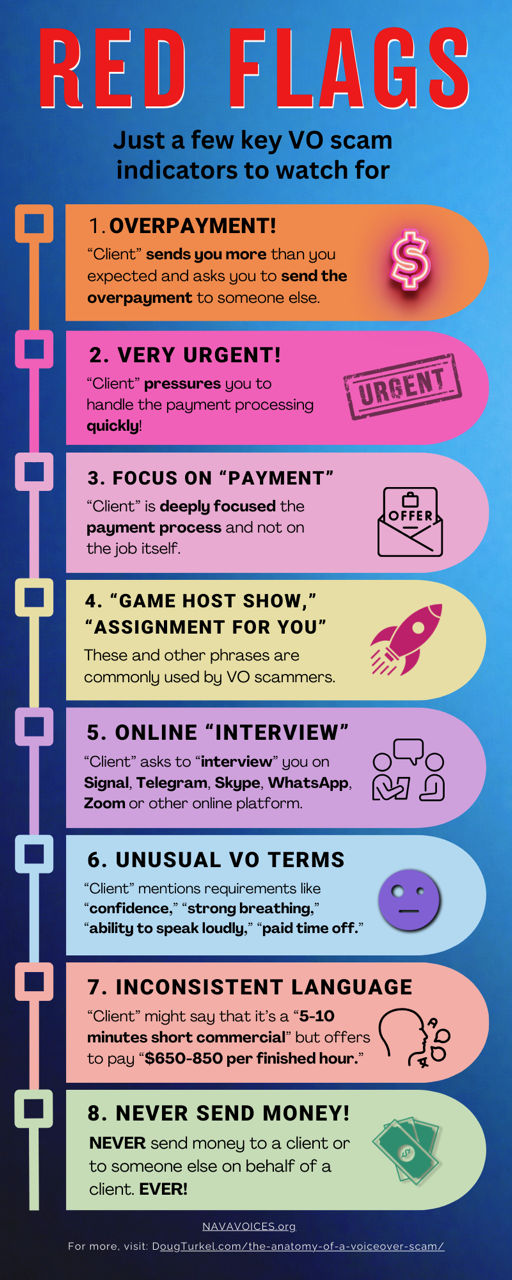

It started like any other project inquiry. Someone reached out via email, very professional-sounding, needing some website design work done—a relatively small project, perfect for filling a gap in my schedule. They wanted a few pages mocked up and developed, nothing super complex. The pay was decent, maybe a little high for the scope, but I figured they were just eager to get it done. Red flag number one, perhaps, but I pushed that thought away. You know how it is, sometimes you just want the work.

We exchanged a few emails. The client—let’s call him “Mr. Smith”—was quick to agree to my rate and terms. No negotiation, which is actually a bit unusual. Red flag number two, totally missed it at the time.

The Payment Arrives

The total agreed-upon price was $1,500. Not huge, but respectable. Mr. Smith insisted on paying upfront, which I generally appreciate. He said he’d send a certified check. Fine by me, I usually prefer bank transfers, but I wasn’t going to fight over how the payment arrived.

A few days later, the check shows up via courier. I open it up, and my eyes just about bugged out. The check was for $4,500! Three times the agreed amount. That’s when the alarm bells finally went off, loud and clear.

I immediately shot an email back to Mr. Smith. “Hey, looks like there was an error with the payment. The check is for $4,500, but the project cost is only $1,500.”

The Follow-Up and The Hook

Mr. Smith got back to me almost instantly. He apologized profusely, claiming it was an accounting mistake, a mix-up with another vendor. He said, “Just deposit the full amount, keep your $1,500, and send the remaining $3,000 via wire transfer to my ‘shipping agent’ who needs to pay for materials right away.”

This is the classic move, right? They send too much money, then they get you to send the difference quickly somewhere else before you realize the initial check is completely fake.

I played along for a second, just to see what the next step was. I told him I’d deposited the check but needed to wait for it to fully clear—which, for a certified check, can take several business days, sometimes longer if the bank is cautious, especially with large amounts.

Waiting and Confirming the Scam

Mr. Smith started applying pressure, emailing multiple times a day, stressing the urgency of getting the $3,000 to his “agent.” He claimed it was a crucial deadline and that I was holding up his entire operation. This frantic urgency is red flag number three, the biggest one.

I went down to my bank branch and spoke to the manager. I showed them the check and explained the situation. They took one look at the check details—the routing numbers, the design, even the signature—and confirmed my suspicion. They said, “This check will bounce. It looks good enough to fool an ATM or a quick teller deposit, but it’s completely fraudulent. If you had wired that $3,000, that money would be gone forever, and when this check eventually fails to clear, you would be liable to cover the entire $4,500 with the bank.”

I felt a cold rush realizing how close I came to losing three grand, or more accurately, being in debt to my bank for four and a half grand.

Wrap Up

I stopped responding to Mr. Smith’s emails. He sent a few more aggressive messages, threatening legal action, which, of course, was laughable. I just ignored them all. I never deposited the check; I actually handed it over to the bank for documentation as a known fraud attempt. They told me these scams are running rampant now, especially against people who work online.

So, the takeaway, folks: if someone pays you significantly more than agreed upon, and then urgently asks you to send the difference elsewhere, STOP. Wait for that money to fully clear, which means waiting for your bank to confirm it’s legitimate funds, not just seeing the amount reflected in your balance. Protect your hard-earned cash, because these guys are relentless.